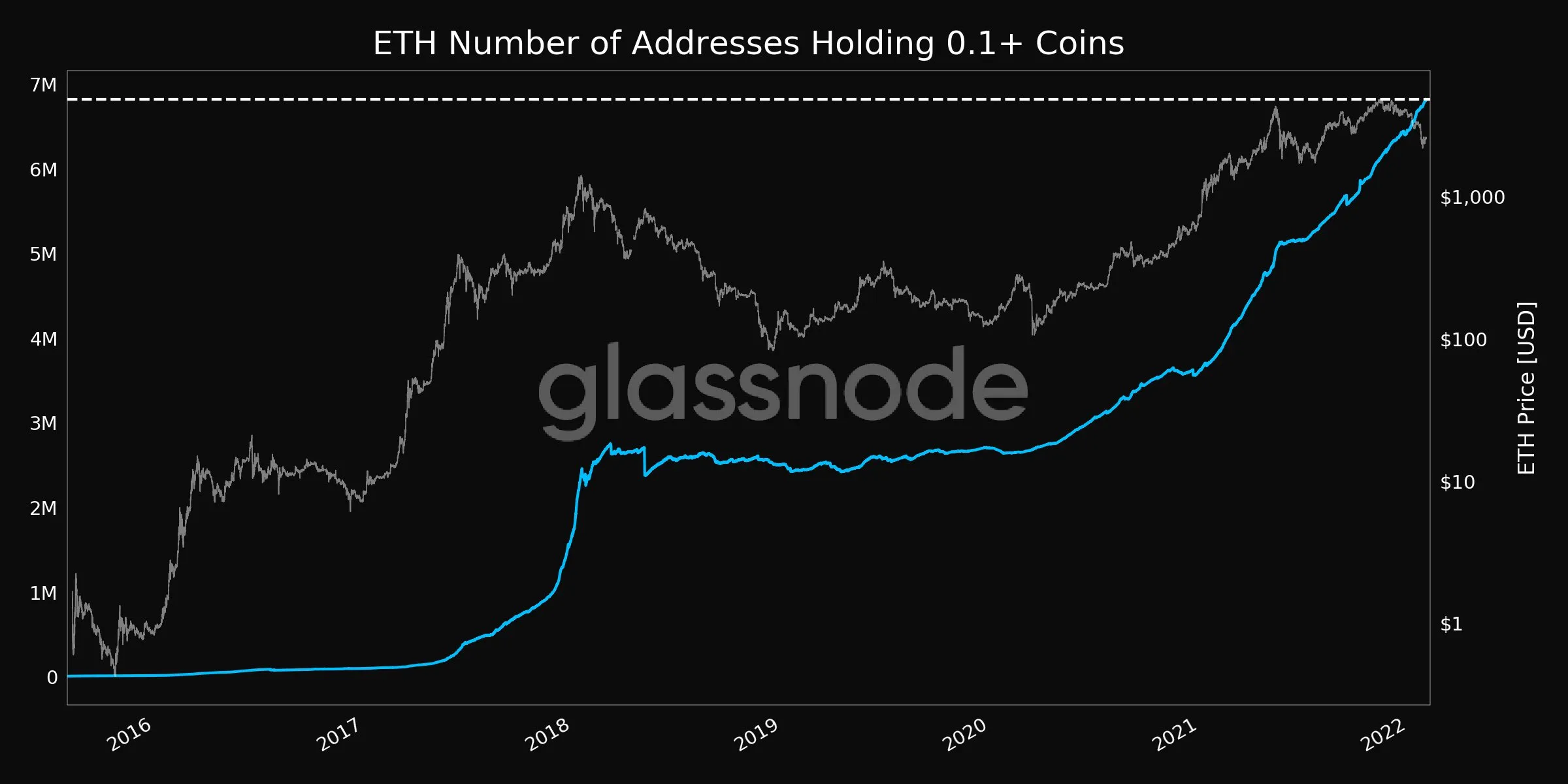

The number of Ethereum addresses holding over 0.1 ETH has reached a new all-time high, data from glassnode shows.

Data from glassnode shows that the number of Ethereum addresses holding over 0.1 ETH has just reached a new all-time high, boding well for the network. The total number of such addresses now stands at roughly 6.823 million.

Ethereum has exploded in popularity and use over the past few years, largely due to the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs). 2021 saw a massive jump in these addresses, going from roughly 3.5 million to 6 million in that year.

Ethereum’s mining hash rate also reached a new all-time high a few days ago, touching 1.1 PH/s. This comes as the network is slowly making its way towards a proof-of-stake system.

However, it’s not all been good news for Ethereum in the past two years. Gas fees have become a significant problem for many users, who cannot afford to make transactions that would incur hundreds of dollars worth of fees.

There is some hope in the fact that the average transaction fee on Ethereum has dropped by over 50% in the past two weeks. Layer-2 scaling solutions have also provided a lot of optimism in this regard, with Loopring, Optimism, and Arbitrum One among the popular solutions. These networks result in negligible transaction fees.

2022 a major year for Ethereum

Ethereum is undergoing a transition to PoS with its ETH 2.0 update, though developers are considering moving away from that name. This is in order to prevent confusion among new users, with the new name in contention being the ‘consensus layer.’

Like the rest of the crypto market, ethereum has taken a huge hit in the recent market crash. But the future appears bright, at least according to Pantera’s CIO.

Other networks, like Solana and Fantom, are also refining themselves in order to give users more incentive to switch, but the latter remains the market’s dominant smart contract and dApp platform. JPMorgan Chase, however, believes that Ethereum has lost some ground to Solana when it comes to NFTs.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply