Key Takeaways

- Ethereum has retraced by more than 20% over the past four days.

- Meanwhile, nearly 193,000 Ethereum has been sent to crypto exchanges.

- Further selling pressure could trigger a correction toward $600.

Share this article

Ethereum looks like it’s at risk of a steep correction as crypto’s rocky June draws to a close. Market participants are rushing to exchanges to exit their positions, while Ethereum is sitting on little to no support.

Ethereum Faces Lower Lows

Ethereum looks primed for a significant price movement as selling pressure accelerates.

The number two cryptocurrency has suffered from a price drop of over 20% over the past four days. It was trading at a local high of $1,280 on Jun. 26 before dipping as low as $1,015. Notably, Ethereum broke below the crucial $1,000 level on Jun. 18, and the losses could extend further as downward pressure appears to be on the rise.

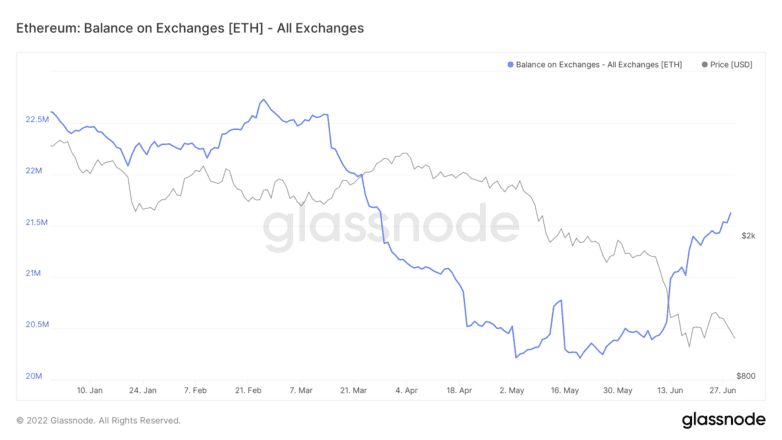

On-chain data from Glassnode shows that the number of Ethereum held on known cryptocurrency exchange wallets has significantly increased. Nearly 193,000 ETH worth roughly $200 million has flowed into trading platforms since Jun. 26. The spike in the balance held on exchanges coincides with the recent downward price action, hinting at a sell-off.

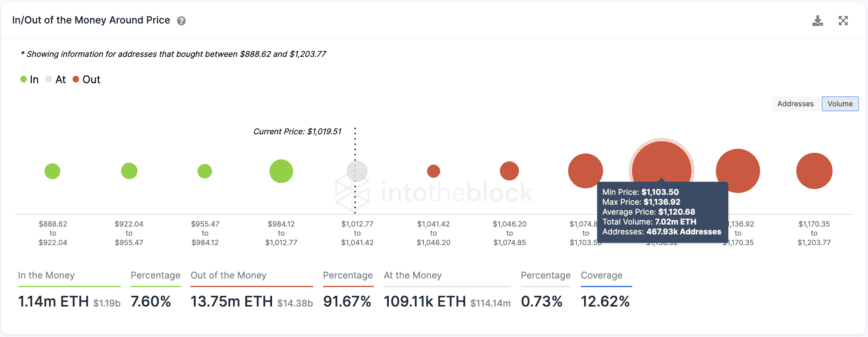

Moreover, transaction history shows that Ethereum lacks the demand it needs to prevent further losses. Ethereum’s next significant support level is at $600, where 12.8 million addresses hold 9.55 million ETH. This interest zone is crucial as market participants may sell their holdings in a bid to prevent their investments from going “Out of the Money.”

The most critical resistance level for Ethereum is currently at $1,120, where 468,000 addresses have previously purchased over 7 million ETH. A daily candlestick close above this hurdle could invalidate the pessimistic outlook, potentially leading to a surge to $1,300 or even $1,500.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Leave a Reply