While most crypto investors have been tightening their belts in the current bear market, crypto millionaires have profited from innovative decentralized finance (DeFi) products, including Uniswap, Aave, PancakeSwap, DAO Maker, and self-custodial wallets like MetaMask.

The bear market is taking its toll on the average crypto investor. But why not learn how DeFi pros make millions using tools you may never have heard of.

Crypto Millionaire Tip #1: Uniswap Gems

Uniswap is a decentralized exchange (DEX) on the Ethereum blockchain that offers DeFi users the ability to earn transaction fees by contributing liquidity. Anyone can create markets by depositing both assets of a trading pair into a smart contract, removing the gatekeeper in the creation of liquidity.

The DEX charges a fee of 0.3% on all trades. Liquidity providers earn passive income from those fees, proportional to the amount of liquidity they contribute minus impermanent loss.

Say you deposit 4 DAI and 4 USDC. The ratio between them is 1:1. Any change in the price ratio between the two results in an impermanent loss. Liquidity providers prefer high trading volumes and low impermanent loss.

Sometimes, traders create markets with less famous altcoins called “gems.” These are crypto assets with market capitalizations of under $20 million that have solid fundamentals and have the potential for a 100x price increase. Traders can use Uniswap to make a trade early before these coins get listed on exchanges and increase in price.

One crypto trader turned $800 into $1,000,000 by trading assets under a day old and making a profit in under 3 hours. They learned about these assets through Uniswap listing bots and Telegram pre-sales marketing.

Crypto Millionaire Tip #2: Aave

Crypto millionaires also use Aave to earn passive income. Aave is a borrowing and lending protocol that allows DeFi power users to earn passive income.

Lenders who deposit funds into a lending smart contract make interest set by an algorithm. Borrowers deposit collateral of a crypto asset into a borrowing smart contract to earn yields or borrow other cryptos. They generally can only borrow assets worth up to 75% of their collateral.

One of the ways they use this to their advantage is by depositing an asset like Bitcoin, which earns a low yield in DeFi because of its vast ownership, to borrow a stablecoin. They can then make a higher yield on the stablecoins by depositing them into a DEX liquidity pool. Aave also offers an annual percentage rate of 8% for borrowing the stablecoin USDT.

Aave will liquidate your position and take your collateral if your collateral falls below a certain threshold. This liquidation risk prevents many people from participating.

Crypto Millionaire Tip #3: Yield farming

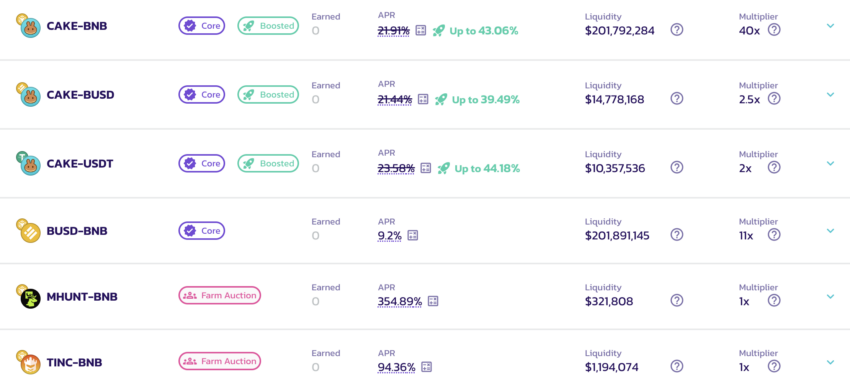

Another more complex strategy crypto millionaires use is yield farming, which can occur on a decentralized exchange like PancakeSwap.

On PancakeSwap, traders earn Liquidity Provider tokens by contributing a cryptocurrency trading pair to a liquidity pool. The LP token allows them to enter a FARM on the DEX, where they can stake their LP tokens with other traders to earn annual percentage rates between 2% and 200%. They are paid out in CAKE through a harvesting process.

To maximize gains, CAKE can be automatically or manually harvested and re-invested in the same pools using Syrup Pools.

Crypto Millionaire Tip #4: IDOs

An initial DEX offering (IDO) is a new way that crypto millionaires have discovered. A decentralized protocol raises funds from investors by issuing a token that can represent a newly-listed asset on their platform.

DAO Maker is an incubation and fundraising platform for new decentralized autonomous organizations that gives DAO tokens to investors in projects. DAO token holders, who are proven investors, can participate in an IDO’s Strong Hold Offer (SHO) token sale.

Since its launch in 2021, the DAO token has created returns as high as 41-times for early bird adopters.

Crypto Millionaire Tip #5: Self-Custodial Wallet

A common requirement for using DeFi products is a self-custodial crypto wallet.

A crypto wallet is software or hardware that essentially stores unique strings of numbers and letters called keys that authorize your access to spend crypto. Each wallet contains both a public key and a private key. The public key is used when sending crypto to someone, while a recipient can use a private key to spend crypto in their wallet.

When someone wants to spend crypto in their wallet, they present a public key and a signature created from the private key. These two pieces of information tell the blockchain network that the spender owns the funds they are using.

While some crypto users give up control of their keys to companies like Coinbase, Binance, or Kraken, users heavily engaging in DeFi generally maintain control over their keys. They store them in a self-custodial wallet instead of a custodial wallet managed by a company.

The responsibility of controlling and managing these keys then becomes their responsibility solely. If they lose their private key, they lose access to their crypto because they can’t create a public signature to spend any crypto they receive. Hence the mantra, “Not your keys, not your crypto.”

Popular Self-Custodial Wallets

Popular self-custodial wallets include MetaMask and LedgerNano. MetaMask is a software wallet that you can download as an extension for the Google Chrome browser.

Once installed, the MetaMask software will prompt you to enter a password. The software will create a wallet for you. It will then show a 12-word mnemonic phrase that you can use to recover your funds if something happens to your computer. It is essential to store this phrase securely since anyone that finds it will have access to your wallet.

Ledger Nano is a USB-based hardware wallet that works through a companion app. You can purchase the wallet on Amazon or directly from Ledger, although the latter is safer.

After you install the app, it will prompt you to answer a few questions to ensure that the device still has the same security programmed at the Ledger factory. Then the device will present you with a mnemonic that you must store securely.

Like MetaMask, the mnemonic is the only way to access your funds. After storing the mnemonic, you can move your crypto from exchanges by setting up an account on the companion app for each of the cryptocurrencies you want to move.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply