MATIC was one of the few cryptocurrencies to register high gains prior to the FTX fall. The crypto market’s doom, however, has now pulled Polygon back to the pre-rally levels.

Polygon (MATIC) price rallied by over 40% in the days before the FTX fall and larger crypto market crash. At the time of writing, MATIC, the 10th-ranked crypto by market cap, traded at $0.78, down 11.40% on the weekly window.

While Polygon price action concerned holders and investors, it wasn’t just double-digit losses that raised eyebrows.

50 Billion MATIC Moved

Price volatility often leads to on-chain transfers and redistribution of tokens or coins. Thus, when Polygon price took a hit, long-term holders and investors started to move old coins.

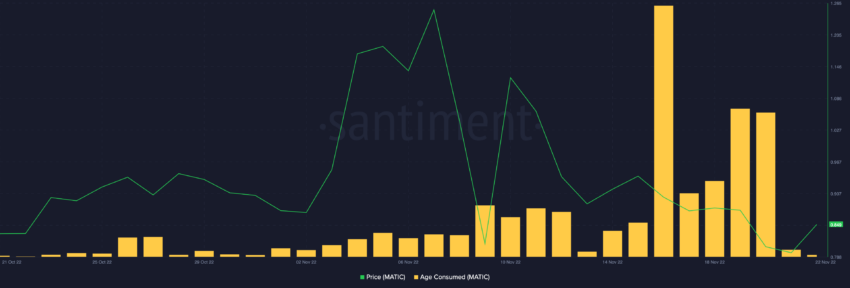

The Age Consumed indicator from Santiment suggested that older MATIC has been moved in the last month than in the last three combined. Age Consumed showed significant spikes from Nov. 16.

Spikes on Age Consumed signal a large number of coins moving after being idle for a long time. In the last four days, 51.30 billion MATIC has been moved as old coins kept circulating.

The first spike in Age Consumed metric showed up on Nov. 16 when 42.98 billion MATIC was moved. Polygon price soon dropped after the large amounts of coins were moved on-chain.

Alongside old coins being moved, data from Whale Alerts suggested that a MATIC dumped 9,000,000 MATIC worth $7.22 million from an unknown wallet to Binance. Coins being sent to exchanges often point towards either liquidation, or the intention to liquidate to cut losses if the price drops

So Why the Fear?

Looking at on-chain metrics for Polygon, it was clear that holders were in pain as MATIC price traded 70.61% below its all-time high. In fact, short-term holders that have accumulated during the recent price were also in steep losses.

Long-term MVRV (market value to realized value) for Polygon treaded in the negative territory, presenting that long-term participants were underwater. Two-year, 365-day, 180-day, and 90-day MVRVs were in the negative territory, showing that long-term holders realized losses.

At the time of writing, however, MATIC price made some short-term gains, appreciating by 4.37% in the last 24 hours.

The bump in price could largely be attributed to market volatility and a few developments taking place in Polygon’s ecosystem. Partnerships have previously aided Polygon’s positive price momentum. For one, Polygon announced its partnerships with CV Labs to support the development of blockchain technology in Africa.

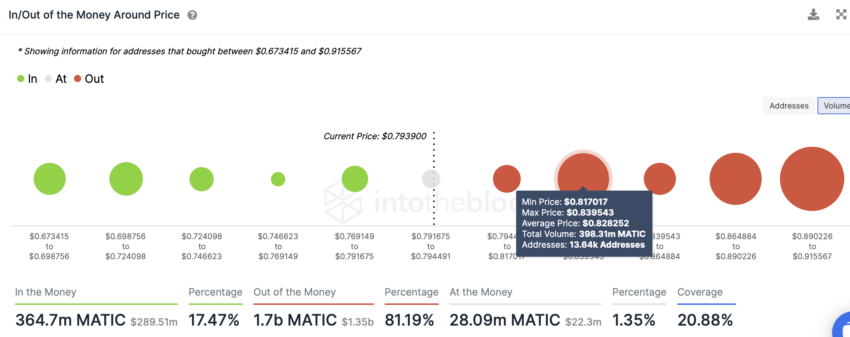

Despite the short-term price uptick, expecting solid gains in the near term would be unrealistic. However, if Polygon bulls are able to push prices above the $0.8280 mark, where 13640 addresses hold over 398 million MATIC, some positive momentum can be expected.

Polygon In/Out of Money Around Price indicator suggested that the coin had no major support wall to hold the price until the $0.698 level. Furthermore, with the larger market, mostly volatile prices could swing in either direction.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply