Crypto news: We bring you a recap of the biggest stories in crypto over the past week. And we start with a report which suggests the Land of the Free is seeing its freedoms failing.

According to a Reason magazine report on June 21, the United States has fallen to 25th in the world for economic freedom. And it was once ranked fourth.

Fortune Favors the Bold

The big reason the US fell in the rankings is that Congress is spending more than it can raise in taxation. Plus, American policymakers “add thousands of regulations, most of which restrict individual freedom,” the report noted.

The foundation ranks a country’s economic freedom based on factors such as the rule of law, regulatory efficiency, open markets, and fiscal health. Singapore topped the rankings, with honorable mentions for Taiwan, Ireland and Switzerland.

Singapore has been a destination of choice for several high-profile American crypto and fintech firms recently. Both Ripple and stablecoin issuer Circle have recently been granted payment licenses to operate in the Asian island nation.

Crypto – Socially Speaking

Reddit Red Card

Referred to as “the front page of the internet,” Reddit has long been a major source of crypto news, view and gossip. But its band of volunteer moderators are up in arms over proposed changes to the site’s data access policy which would lead to the site charging for access to its application programming interface (API).

One of the major driving forces behind Reddit’s decision is the potential value of its data for generative AI. Reddit, acting as a platform where all things on the internet gather and receive constant updates, possesses data that could transform into a gold mine for AI algorithms.

Still, developers argue that Reddit is pulling the plug on third-party apps, leading to a mass protest by subreddit moderators.

Crypto-centric subreddits like r/cryptocurrency, r/bitcoin, and r/ethereum joined the blackout. These subreddits went private or shifted to read-only alongside approximately 7,000 other communities.

Tether to the Moon

Stablecoin issuer Tether is set to make bumper profits this year making one of America’s most profitable companies. To some analysts, its earnings could be even greater than those of asset manager BlackRock.

Its profits could reach $6 billion in 2023 due to the fact that USDT is backed by high-earning U.S. treasuries. Barron’s reported that stablecoin firm Tether is crushing the crypto competition. It behaves like a bank by investing people’s deposits in reserves such as Treasuries, earning 5%.

With an estimated $6 billion in profits predicted this year, the firm is a “financial giant,” the report noted.

What are stablecoins? Click here for our Learn guide.

Sleeping Beauty

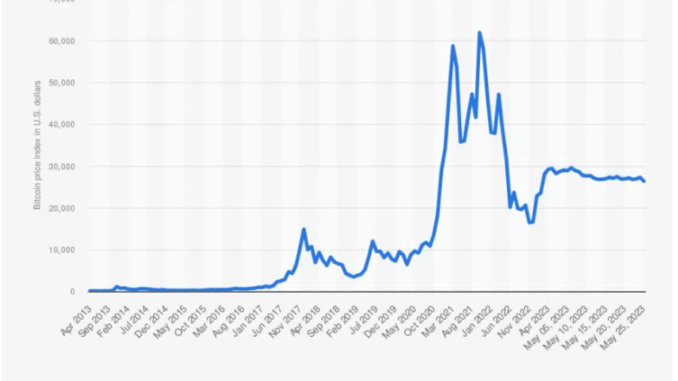

The amount of Bitcoin (BTC) sitting dormant is on the rise, despite hitting a new 2023 high this week. Every day, new record highs are being set in the amount of Bitcoin supply that has not moved in at least a year.

Analyst Will Clemente said:

“This is even more impressive considering a year ago was when BTC initially dropped down to $20K following the Luna collapse.”

On-chain analyst “@therationalroot” reported that the supply available to trade has declined since the third halving in May 2020. This may be due to accumulation, long-term holding, or institutions buying and locking away the asset.

Either way, it should positively affect price action since there are fewer Bitcoins to buy and sell.

However, some could argue that holding BTC means not using it, which negates its properties as decentralized money. The counter-argument is that BTC is being used as a store of value in times of high inflation and diminishing fiat values.

Crypto Coin News

Are you new to trading cryptocurrencies and looking for a way to practice without risking real money? Click here for our Learn guide.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply