A new Hong Kong University paper pushes the government to issue a Hong Kong dollar digital currency (HKDG) to curb dependence on US dollars as the digital asset industry sets up shop.

Penned by academics from the Hong Kong University of Science and Technology, and Web3 industry players, the document argues for government support because a privately issued HKDG stablecoin cannot compete with US dollar-denominated stablecoins’ multi-billion-dollar market caps.

Paper Urges HKD Stablecoin to Unseat Dollar’s Local Dominance

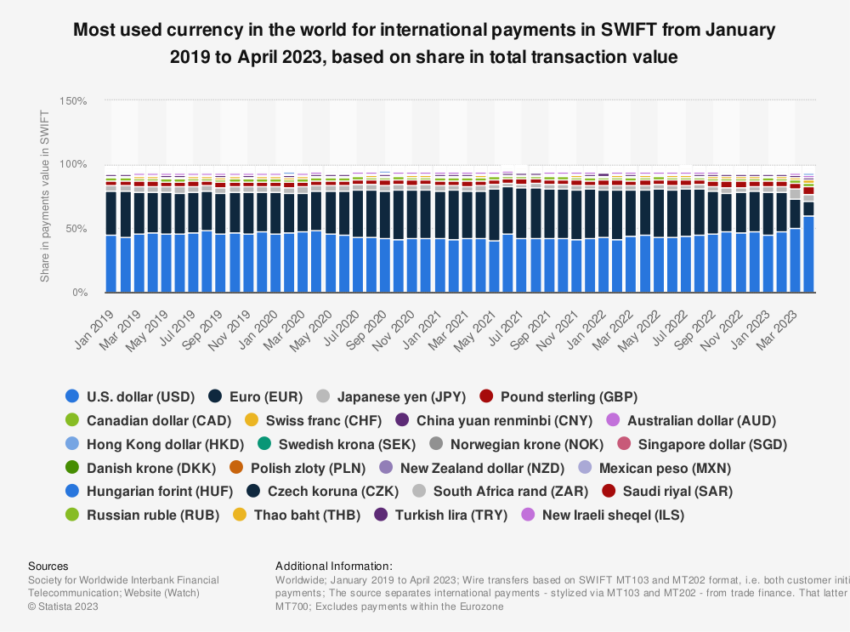

While HKDG may not upset the dollar’s global hegemony, HKDG could erode the US dollar’s dominance in the government’s $430 billion foreign reserves.

The authors argue it will also set the stage for digitizing other assets to make them more liquid and allow for greater financial inclusion.

In addition, the coin will improve the Hong Kong dollar’s cross-border liquidity and increase transaction efficiency. Moreover, it will marry blockchain’s inherent transparency with government regulation to protect users.

The Hong Kong Securities and Futures Commission (SFC) confirmed its work on laws for stablecoins in June.

Get the big picture on stablecoin regulations here.

While the regulator recently set out new rules for crypto service providers, the list of assets they can offer doesn’t include stablecoins. Crypto traders often park dollars in stablecoins, which can buy other crypto assets quicker than traditional fiat and are a crucial link between the crypto and fiat worlds. Hence the paper’s push for the HKD stablecoin which could boost crypto volumes.

Hong Kong Banks Could Stifle Crypto Businesses

The SFC recently met with Gemini founders Cameron and Tyler Winklevoss to discuss Gemini’s expansion into the region.

However, banks in the region seem reluctant to serve crypto exchanges. This resistance seems to conflict with Hong Kong’s somewhat strict but arguably workable digital currency framework.

Recent accusations against the world’s largest crypto exchange, Binance, revealed internal admissions that people used the company for crime. That, and the collapse of an exchange with roots in Hong Kong, FTX, has caused local banks to treat the digital asset industry gingerly.

HSBC bank was fined ten years ago for letting a Latin American drug cartel launder funds. It and Standard Chartered have so far refused to offer crypto companies services in Hong Kong.

As a result, executives have had to walk a fine line. They are trying to stay in Hong Kong’s good books while limiting legal liability should something go wrong.

Bank executives are also trying to grapple with frayed political ties between the East and West. Since Russia’s invasion of Ukraine, China tested the yuan’s potential to replace the US dollar in international trade.

The SFC has since asked the banks why they are reluctant to engage the industry.

Without support from trusted banks, crypto adoption, especially at an institutional level, will be a hard sell.

Got something to say about the Hong Kong University paper pushing for an HKD stablecoin or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply