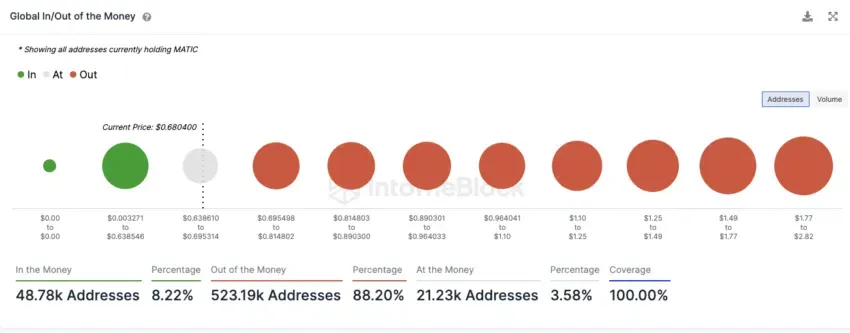

Only 8.2% of Polygon addresses can currently sell their MATIC at a profit. Will the bearish trend continue?

88% of MATIC Holders ‘Out of the Money’

A significant majority of Polygon addresses are currently in a loss position, with approximately 88% of them facing potential losses if they were to sell their MATIC tokens at the current market price.

Conversely, only about 8.22% of addresses would generate a profit, while approximately 3.58% would break even.

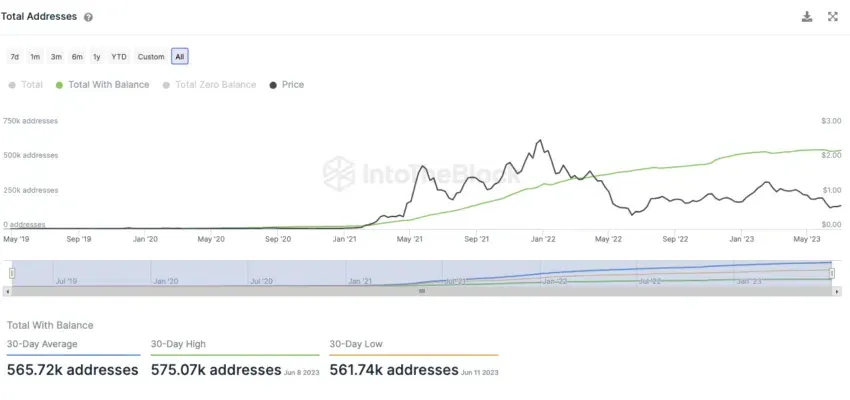

The Total Number of Polygon Addresses Is Still on an Upward Trend

The total number of Polygon addresses continues to rise, indicating ongoing growth, although the rate of increase is showing signs of leveling off.

Over the past thirty days, an average of approximately 565,000 MATIC addresses have been recorded.

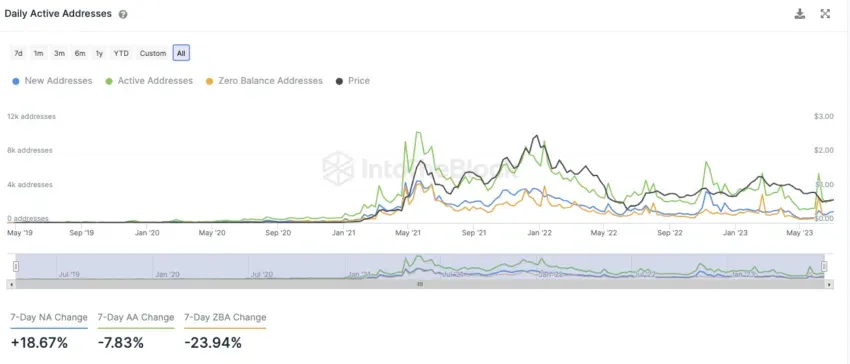

The Number of Active Addresses Has Fallen Again

In the past seven days, there has been a decrease of approximately 7.8% in the number of active addresses on the Polygon network. Additionally, the number of MATIC addresses without any transactions has decreased by around 24% during the same period.

However, there has been a positive development, with an increase of approximately 18.7% in the number of new addresses created.

The Mood on Telegram Remains Positive

The sentiment surrounding Polygon on Telegram appears to be predominantly positive, with nearly five times as many positive messages as negative ones.

The count of positive Telegram messages about Polygon stands at around 410, compared to approximately 90 negative messages. However, it is worth noting that there has been a notable decline in the number of Telegram users since 2021.

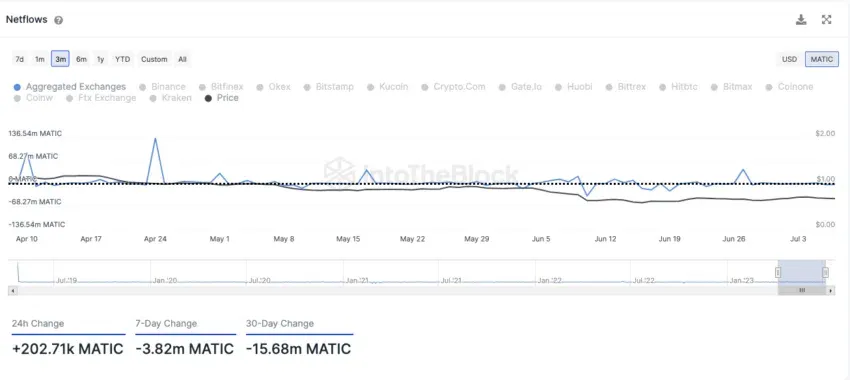

MATIC Withdrawn from Exchanges Outweighs Deposits

Over the last 24 hours, a surplus of approximately 200,000 MATIC has been deposited on exchanges, indicating a higher inflow than outflow.

However, this differs from the trend observed in the past seven and 30 days, where approximately 3.82 million MATIC tokens, equivalent to around 15.7 million USD, were withdrawn from exchanges more than deposited.

When coins are withdrawn from exchanges instead of being deposited, it suggests reduced selling pressure and tightening the token supply. Therefore, this can be seen as a bullish indicator for price development.

15% of Polygon Supply Is in the Hands of Retail Investors

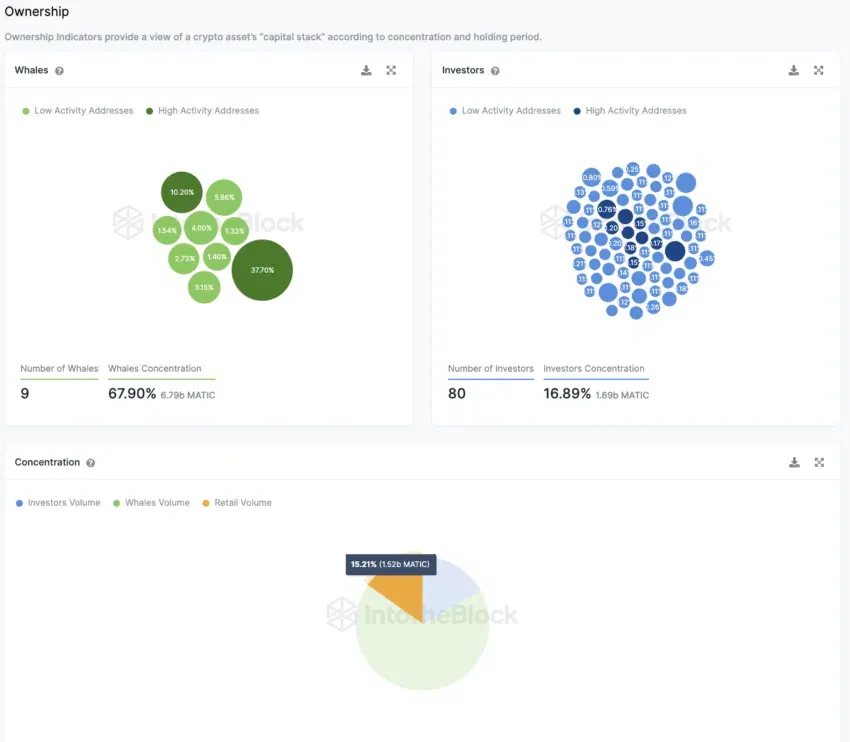

The distribution of Polygon tokens in circulation reveals an interesting pattern. Specifically, a notable concentration of holdings among a small number of large investors.

Approximately 80 addresses hold around 16.89% of the total supply. These addresses’ holdings range between 0.1% and 1% of the total tokens. This concentration highlights these large investors’ influence on the Polygon ecosystem.

A closer examination of the Polygon ecosystem reveals the significant presence of whales. Whales refer to addresses holding more than 1% of the total MATIC volume. One such address holds an impressive 37.7% of the total supply. While eight other addresses collectively control 30.2% of the coins.

These whales account for approximately 67.9% of the MATIC supply, leaving only around 15.21% for retail investors. With nearly 90% of addresses in the red, the token ownership appears to be heavily concentrated among institutional investors and whales.

Therefore, the success of their long-term investment strategy remains uncertain, as their current gains seem limited.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Leave a Reply