The Dutch central bank approved Crypto.com’s license to provide citizens with crypto services soon after competitor Binance fell afoul of local compliance requirements.

De Nederlandsche Bank approved the exchange after conducting a review of its compliance with Dutch anti-money laundering and anti-terrorism financing laws.

The approval is a significant milestone for the company, as Europe’s Markets-in-Crypto-Assets bill, set to go into effect in 2024, allows service providers in one region to operate across the entire European Union.

With its Dutch license, Crypto.com can secure business in all 27 member states in the European Union when MiCA starts operating in late 2024.

Get a full list of all European crypto exchanges here.

However, the exchange will compete with 36 crypto companies already holding licenses from the central bank. These include Coinbase Europe, OKCoin, eToro, and BitStamp.

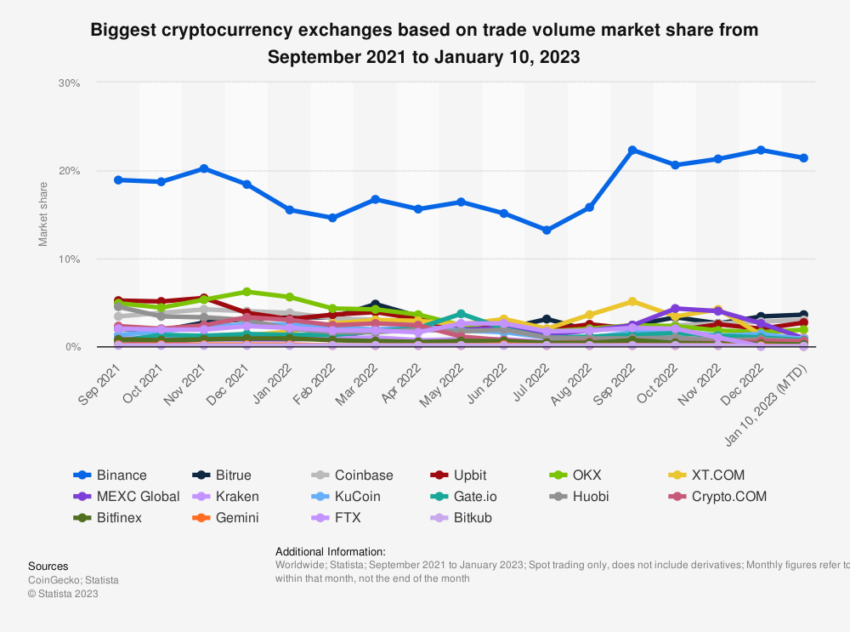

Statista said Coinbase accounted for 3% of global trading volume as of Jan. 10, 2023.

In comparison, Crypto.com processed only 0.6% of global trading volumes in January. This proportion is a 2.7% decline from the 3.3% share it enjoyed in December 2021.

Largest Exchange Fails Dutch Review

After failing the Dutch regulator’s review, Binance, the largest exchange by trading volume, has no presence in the Dutch market.

It offloaded its clients to local rival Coinmerce after repeated attempts at securing regulatory approval failed. Coinmerce has been operating as a licensed crypto business in the Netherlands since November 2020.

Yesterday, reports surfaced that Binance withdrew a license application with Germany’s finance watchdog, BaFin.

However, a license from French authority Autorité des Marchés Financiers (AMF), as well as approval from regulators in Lithuania, Poland, Spain, Sweden, and Italy, have secured its EU presence ahead of MiCA. But it may soon face operational challenges after a payment partner recently scrapped a deal to process euro deposits and withdrawals.

In the meantime, authorities in France are investigating charges of aggravated money laundering at the exchange. As of late June, Binance still listed privacy coins in conflict with MiCA’s anti-money laundering rules.

Got something to say about the Dutch license Crypto.com secured or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply