The Ethereum (ETH) price has decreased since July 14, when it reached a new yearly high. The price has bounced at an important Fib support level since but has yet to confirm the trend’s direction.

The wave count suggests that the price has either reached a bottom or will do so soon. The short-term price action supports this possibility by creating a higher low.

Has Ethereum Price Completed its Correction?

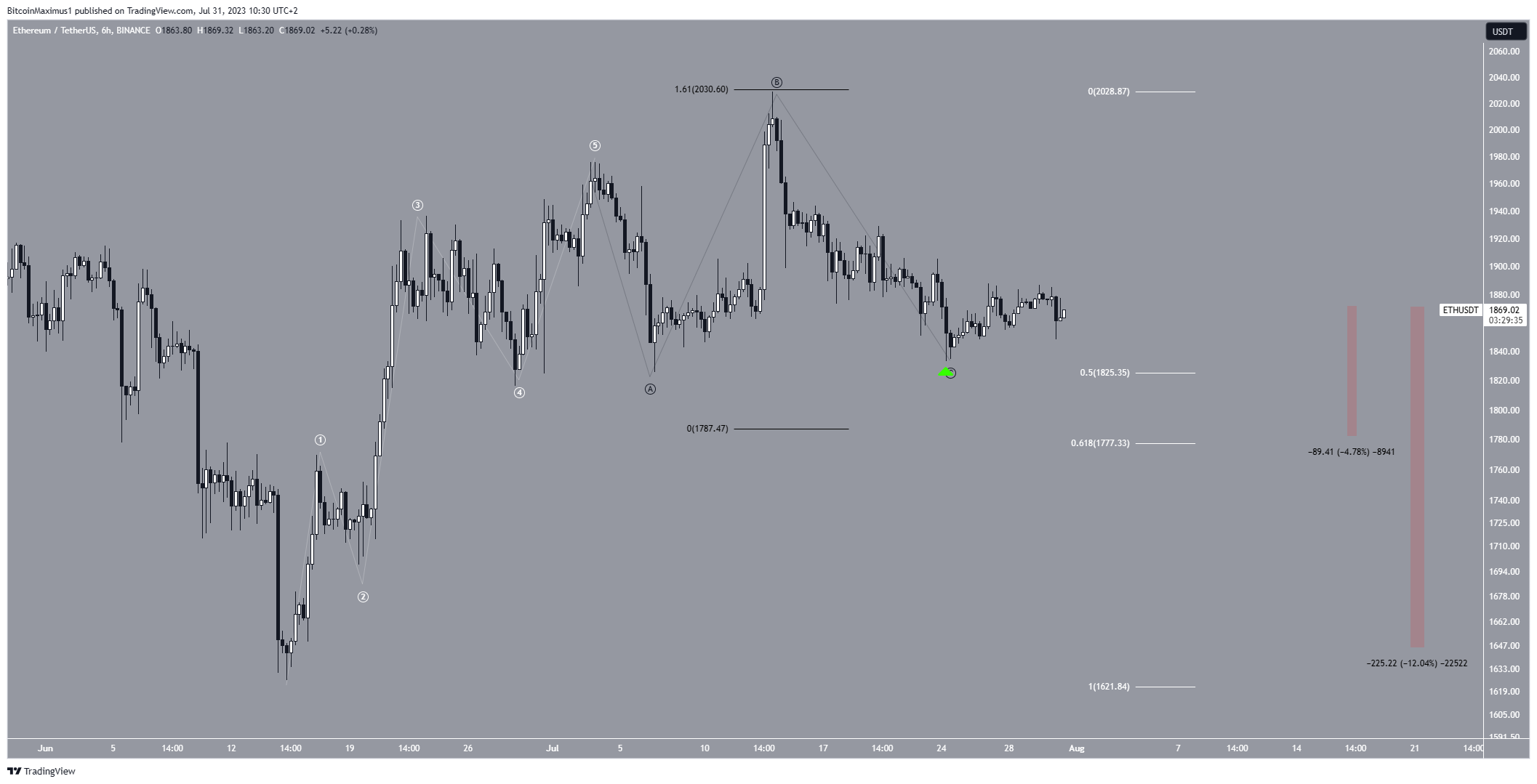

The technical analysis of the shorter-term six-hour time frame gives two possibilities for the future movement, both based on the wave count.

According to the Elliot Wave count, the price of ETH has completed a five-wave increase (white) and is now experiencing a corrective A-B-C structure. Presently, it appears to be in the C wave, which will complete the correction.

Technical analysts use the Elliott Wave theory to determine the trend’s direction by studying recurring long-term price patterns and investor psychology.

However, it is not clear if the price has completed its correction or if another low will follow.

The bullish possibility suggests that the correction is complete. This is supported by the fact that the ETH price bounced at the 0.5 Fib retracement support level at $1,825.

The Fibonacci retracement levels theory suggests that after a significant price change in one direction, the price is likely to partially return to a previous level before continuing in the same direction.

However, setting waves A:C at a 1:1.61 ratio indicates a potential low around $1,780. This also coincides with the 0.618 Fibonacci retracement support level (white).

Measuring from the current price, a drop to the $1,780 support will be a decrease of nearly 5%. However, if the price closes below the support area, it could fall to the June lows at $1,620, a drop of 12% from the current price.

Additionally, it is worth mentioning that ETH reached its 8-year anniversary on July 30, and its list of achievements shows just how far it has come since.

ETH Price Prediction: Higher Low Can Lead to Increase

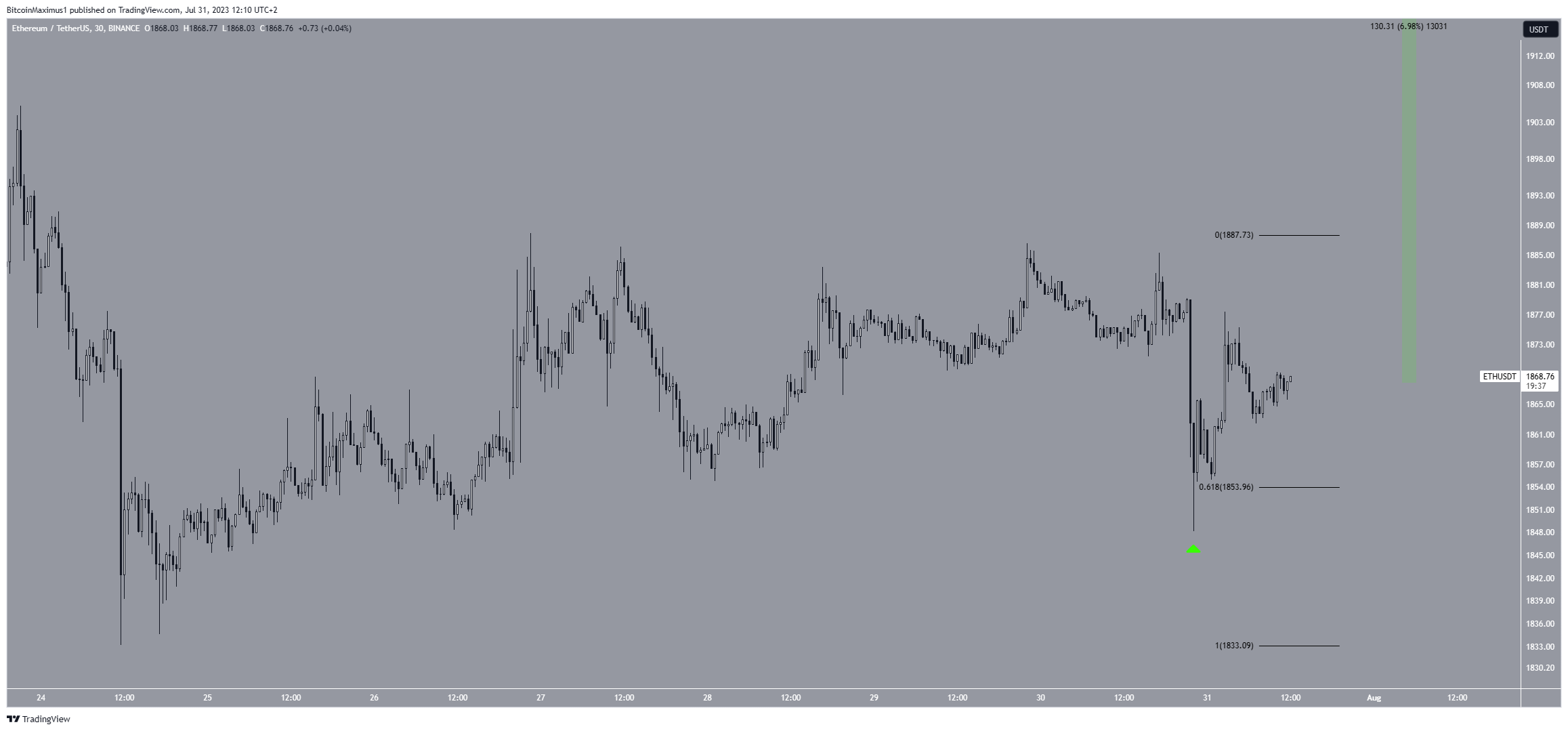

The technical analysis from the short-term 30-minute chart provides a mostly bullish outlook. The main reason for this is the bounce at the 0.618 Fib retracement support level (green icon). The 0.618 level often acts as the bottom is the decrease is corrective.

Moreover, the bounce created a long lower wick, considered a sign of buying pressure. Additionally, it created a higher low relative to the price on July 24. All these are considered signs of a bullish trend.

Therefore, they align with the possibility that the correction is already complete. In this case, the most likely future outlook will be an increase towards the July highs at $2,000, an upward movement of 7% measuring from the current price.

Despite this bullish ETH price prediction, falling below the July 30 low of $1,848 (red line) will mean that the correction is not yet complete. In that case, the ETH price could drop to the previously outlined support at $1,780.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Leave a Reply