Grayscale chief executive officer Michael Sonnenshein has expressed concern over whether the firm needs to refile its spot Bitcoin ETF application. The company won its court case against the Securities and Exchange Commission this week, which could affect its previous product filing.

Grayscale’s legal triumph this week would allow the asset manager to convert its Bitcoin Trust (GBTC) into an ETF that invests directly in the asset.

Bitcoin ETF in Limbo

On August 30, Michael Sonnenshein said,

“We will have to see upon the final operational procedures that come through that final mandate that the court will issue.”

Speaking to Bloomberg, he added,

“We don’t know what the final opinion will say until we reach the end of that period, which is 45 days from the ruling.”

This week’s ruling has been viewed by many industry observers as a stinging rebuke to the SEC. However, it is not a green light for a spot Bitcoin ETF launch. The SEC has yet to approve one. Furthermore, it may engage in more procrastination and delaying tactics to bite back at the industry that it has been vehemently attacking all year.

The regulator stated that it was reviewing the decision. Moreover, Grayscale also said it was reviewing the details. It will share more information on the conversion process “as soon as practicable.”

Sonnenshein said the company has not heard from the SEC since the ruling, adding:

“There really shouldn’t be any further grounds like the SEC has been relying on to continue denying these types of products from coming to market,”

He added that the company is “committed to lowering fees when GBTC converts to an ETF.” Its current fee structure is 2%, much higher than typical ETFs.

If you’re interested in trading Bitcoin derivatives, check out BeInCrypto’s guide here.

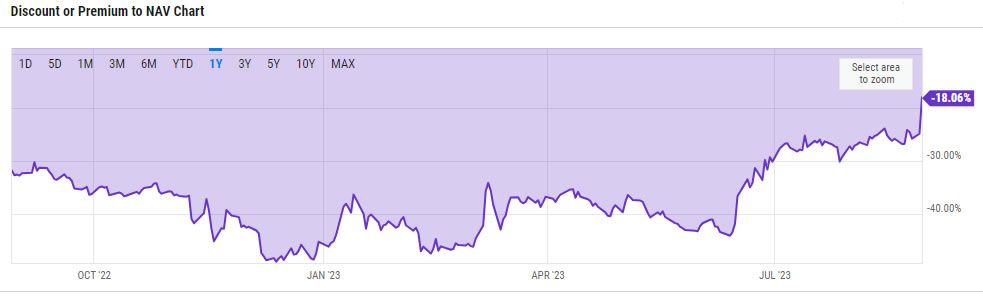

GBTC Discount Diminishing

Furthermore, the GBTC discount has been substantially diminished since the court decision. The premium or discount is the difference between the fund’s net asset value and the market value of the asset.

According to Ycharts, the discount is now just -18%. It fell to almost -50% in December 2022 following the FTX and crypto market collapse.

Bloomberg Intelligence ETF analyst James Seyffart said the discount is unlikely to go to zero until the official conversion.

“The discount shows that the market is more confident in conversion today than they were a few days ago, but still not completely confident that GBTC will convert.”

Moreover, Seyffart and colleagues adjusted their odds of a Bitcoin ETF approval this year up to 75% on Wednesday.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply