Crypto exchange BitMEX has introduced a range of prediction betting, allowing users to trade on various crypto-related outcomes. Among the contracts available are predictions around the recovery of FTX’s customer claims, the SEC’s approval of a Bitcoin ETF, and the legal fate of FTX founder Sam Bankman-Fried.

BitMEX’s Prediction Market products come at a time when the disgraced FTX founder has been denied release from prison once again.

BitMEX Taking Bets on SBF and ETFs

BitMEX recently released a blog explaining the newly introduced Prediction Market products. Users can bet on three crypto-related events and outcomes.

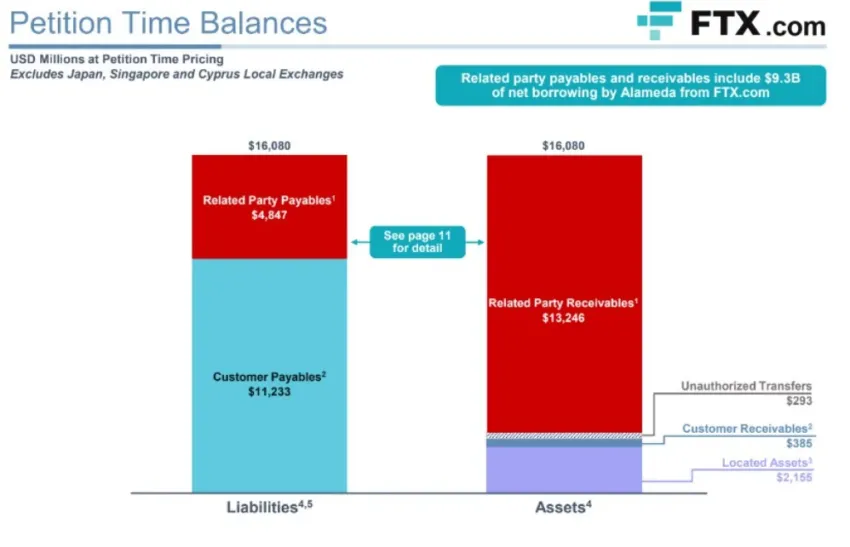

The first will settle based on how much, if anything, can be recovered from FTX customers’ crypto asset claims. When the exchange went under in November 2022, customer withdrawals were locked, leaving any assets customers held on the platform in limbo. This contract expires on December 25, 2026.

The next contract is a wager on whether the SEC will approve or deny a Bitcoin ETF on or before October 17, 2023. Getting the approval of spot price Bitcoin and Ethereum ETFs in the US has been a big talking point in the crypto industry since 2015. Investors are hopeful that regulated crypto ETFs will open an easier avenue for deep-pocket investors to trade in crypto without holding it.

At the time of writing, many big players, like BlackRock, Fidelity, and Grayscale, are all vying to get their Bitcoin ETFs approved. The SEC is biding its time, however, and has delayed all decisions until mid-October.

FTX and SBF Battle Legal Hurdles

The final contract places a bet on whether authorities will sentence former FTX CEO Sam Bankman-Fried to jail before December 2026. The blog also noted, “early settlements will take place if the outcome or event occurs before the contract expiry date.”

Sam Bankman-Fried, the founder of FTX, faces continued legal challenges. Recently, his request for temporary release from prison was denied by Judge Lewis Kaplan.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Meanwhile, the inner workings of the now-defunct exchange are under scrutiny as it goes through bankruptcy proceedings. Recent reports revealed that a substantial amount of prepaid funds were spent for endorsement and partnership agreements. The figure includes a $1.98 million payout to the Coachella music festival.

The cryptocurrency community has been waiting for court approval for FTX to liquidate approximately $3.4 billion in crypto assets. Meanwhile, Bankman-Fried’s legal team examines potential jurors’ experiences with cryptocurrency trading losses as part of their trial preparations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply