FTX Trading Ltd., a prominent player in the crypto market, recently made eleventh-hour alterations to its liquidation plans, bypassing the need for advance public notice.

This strategic move may have been driven by the company’s desire to mitigate the market-moving implications of such a significant transaction.

FTX Liquidation Plan Takes a Turn

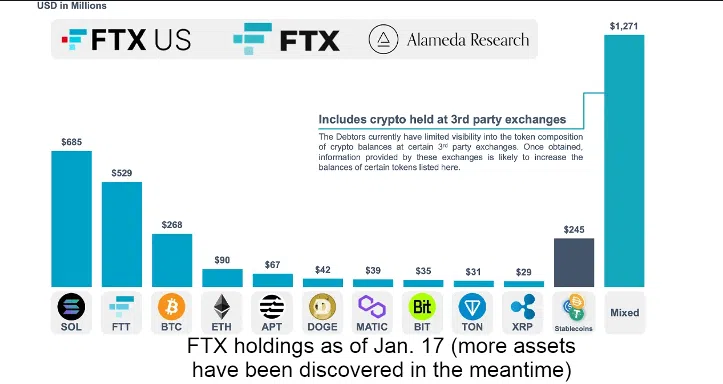

The FTX liquidation plan, authorized by the court, involves the sale or transfer of certain digital assets. This process is to be conducted under guidelines that ensure the integrity of the transactions and the interests of the debtors.

The liquidation, however, could involve the sale of up to $100 million worth of crypto assets per week, a prospect that has already had a cooling effect on prices.

Crypto analytical firm IntoTheBlock commented on the precarious scenario,

“FTX’s impending $3B liquidation could be dictating market movement.”

A Strategic Response

The decision to change the liquidation plan at the last minute seems to be a strategic response to the potential market impact of such a large-scale asset offload.

It’s no secret that the crypto market is particularly volatile. The announcement of a significant liquidation plan could trigger a panic sell-off, leading to a sharp drop in prices. By avoiding advance public notice, FTX may be attempting to minimize this risk.

The court order authorizing FTX’s liquidation plan permits the sale or transfer of digital assets free of any liens, claims, interests, and encumbrances.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The order also allows FTX to enter into post-petition hedging arrangements. These could also provide additional financial protection against the risks associated with a large-scale asset liquidation.

So, FTX’s last-minute change to its liquidation plan appears to be a strategic move. It likely hopes to mitigate the potential market-moving implications of a large-scale asset liquidation.

However, this strategy may raise questions about transparency. The court order that authorizes the plan still suggests that it has considered the interests of all stakeholders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

Leave a Reply