Roni Cohen-Pavon, the former chief revenue officer of the now-bankrupt crypto lender Celsius Network, has reportedly pleaded guilty and committed to cooperating with authorities in their ongoing investigations.

During the court hearing, Cohen-Pavon reportedly confessed to four charges, one of which involved manipulating the price of Celsius’s native token, CEL.

Celsius Executives Give Different Answers to Guilt Charges

According to a September 14 report, Cohen-Pavon entered his guilty plea in the United States District Court of Manhattan.

He reportedly agreed to assist the US Attorney’s office and the Federal Bureau of Investigation (FBI) with investigations and testify in court if necessary.

On July 14, reports disclosed that Mashinsky entered a plea of not guilty to fraud charges. Prosecutors leveled seven criminal counts against him, which included wire fraud, securities fraud, and commodities fraud.

They also asserted that Maskinsky orchestrated a calculated, multi-year scheme profiting $42 million from exploiting customers.

This came only weeks after Cohen-Pavon and Alex Mashinsky were charged with market manipulation and wire fraud. The United States Securities and Exchange Commission (SEC) accused both of artificially boosting the price of CEL.

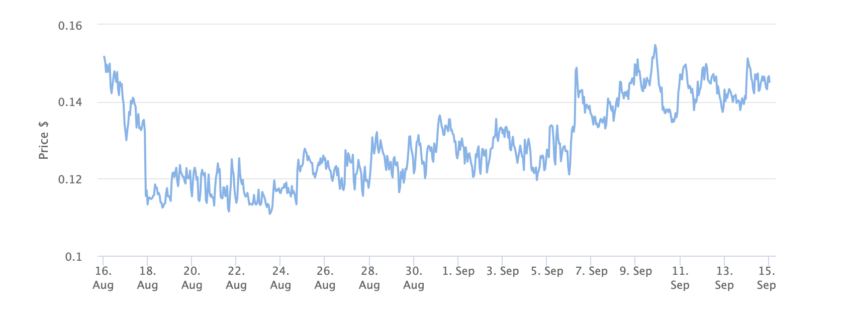

At the time of publication, CEL’s price is $0.14.

The Bear Market Marked a Turning Point For Celsius

The SEC further alleged that both sold their holdings just before Celsius collapsed in July 2022.

Furthermore, the Department of Justice (DOJ), Commodities Futures Trading Commission (CFTC), Federal Trade Commission (FTC), and the US Government lodged comparable charges against Celsius and Mashinsky.

The FTC prohibited the Celsius network from engaging in trading activities and levied a fine of $4.7 billion. Mashinsky, on the other hand, declined to accept the FTC settlement.

Celsius experienced a decline following the peak of the bull market in 2021. At the time, numerous crypto companies provided high yields on digital asset loans.

However, with the arrival of last year’s bear market, several crypto-lending firms declared bankruptcy. Millions of dollars belonging to users are currently stuck on these platforms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply