Open Exchange’s (OPNX) co-founder Su Zhu’s arrest triggered a crash in the value of the exchange OX token. Zhu is also the co-founder of the now-defunct crypto hedge fund Three Arrows Capital (3AC).

According to Alphanomics, news of Zhu’s arrest prompted the fire sale of approximately $1 million worth of OX tokens.

OX Token Value Craters

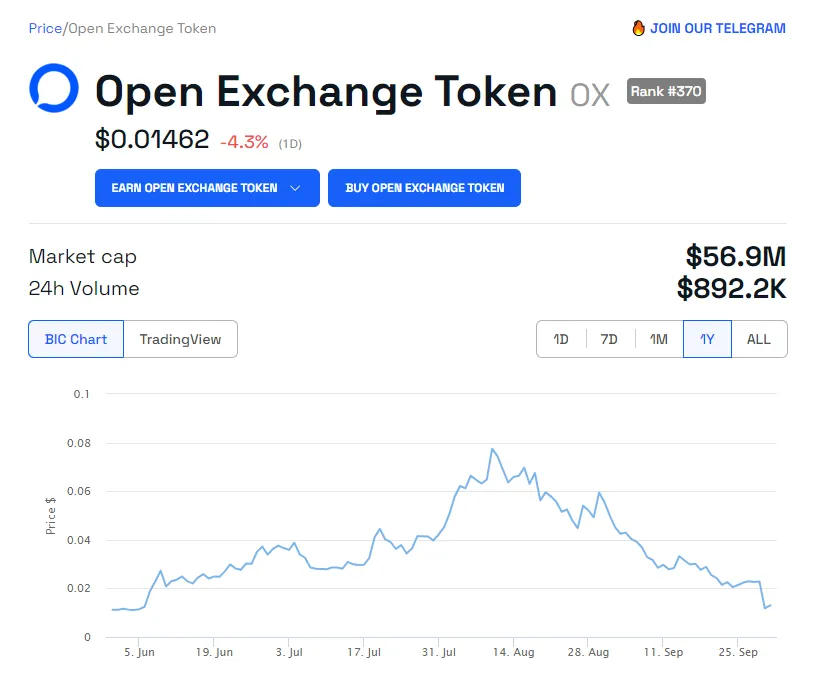

This sudden wave of selling, combined with negative sentiments surrounding Zhu’s arrest, resulted in OX plummeting to an all-time low of around $0.010, per BeInCrypto data.

While there has been a minor recovery to $0.01462, the token’s value remains down by more than 80% from its all-time high.

Furthermore, this sharp decline in the token’s value caused its market capitalization to drop by over $30 million. Its market cap stands at around $57 million as of press time.

OX is the native token for OPNX, a specialized exchange designed for trading claims of insolvent crypto firms like FTX. Holders of OX tokens enjoy reduced trading fees on the platform and participate in its governance activities.

OPNX was launched in April amid controversy due to its association with 3AC co-founders and the struggling CoinFLEX exchange.

Coingecko data reveals that the platform’s spot trading volume is less than $20,000, while its derivatives market boasts a trading volume of nearly $70 million in the last 24 hours.

What Next After Zhu’s Arrest?

Zhu was apprehended in Singapore on September 29 while attempting to flee the country. According to reports, he faces a four-month prison sentence following a committal order from a Singaporean court.

Zhu and his partner Kyle Davies led the multibillion-dollar fund 3AC. At its peak, the fund controlled about $10 billion worth of assets, making it one of the most prominent companies in the space.

However, the firm was one of the first to collapse following the record market downturn of last year.

The fallout of their actions resulted in Singaporean authorities imposing a multi-year trading ban on the fund’s founders. Meanwhile, 3AC liquidators Teneo consistently complained that both co-founders had been uncooperative during the liquidation process.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply