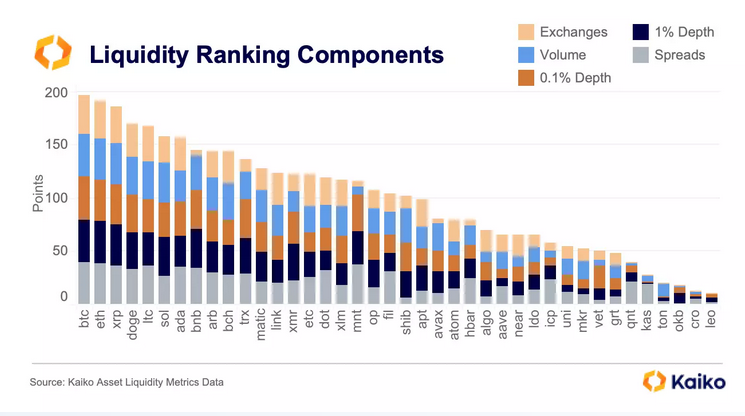

An analysis by blockchain analytics platform Kaiko revealed that XRP and Dogecoin (DOGE) are among the top four most liquid cryptocurrencies, only trailing Bitcoin (BTC) and Ethereum (ETH).

This finding challenges the conventional wisdom that market capitalization is a wholesome metric for evaluating a cryptocurrency’s price, and thus, liquidity.

Assessing Crypto Liquidity: What Factors Were Considered?

In their report, Kaiko argues that liquidity, which measures how easily an asset can be traded, is a more accurate representation of a cryptocurrency’s true worth. Market capitalization and fully diluted value, according to Kaiko, provide an incomplete picture of a cryptocurrency’s value proposition.

To measure market capitalization, the asset’s price and tokens in circulation play a critical role. Meanwhile, liquidity considers multiple factors often beyond prices, including supporting exchanges and the cost of trading the same asset, quantified through spreads.

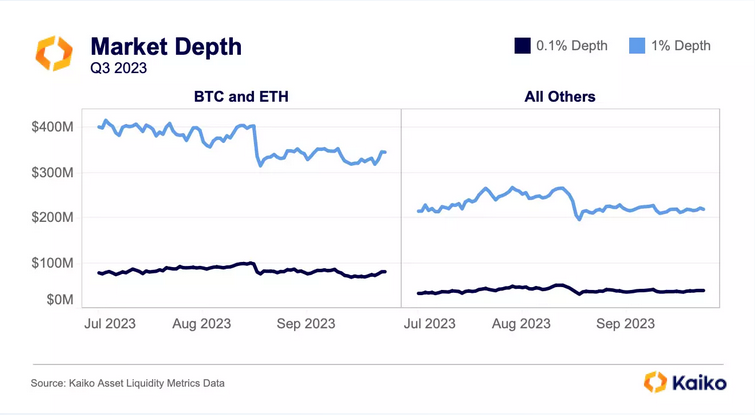

Gauging asset liquidity, Kaiko’s analysis took into account two market depth levels: 0.1% and 1%. To properly assess the level of liquidity for traders, market depth at 0.1% was used as a metric. Meanwhile, the 1% market depth reading was used to track the liquidity of long-term holders.

Herein, Kaiko said liquidity across both categories fell across the board in Q3 2023.

XRP, DOGE, And LTC Shining, AVAX Drops

Kaiko notes that XRP, DOGE, Cardano (ADA), and Solana (SOL) all performed in line with their market capitalization rankings regarding liquidity. XRP and DOGE emerged among the top four, though they generally remained some of the most liquid, using market capitalization as lead.

Even so, Litecoin (LTC) outperformed its market cap rating to place fifth among the most liquid cryptocurrencies. According to CoinMarketCap, LTC is ranked 17th with a market cap of over $5.6 billion.

While LTC outperformed, others, including Uniswap (UNI), Avalanche (AVAX), Shiba Inu (SHIB), and Cosmos (ATOM), dropped in the liquidity rankings. AVAX posted sharp liquidity losses, dropping 11 spots. This is despite the coin’s stellar performance in the past few trading months.

To quantify, AVAX has outshone Bitcoin (BTC), rallying by over 400% in the last two months alone.

Meanwhile, because of how well Bitcoin Cash (BCH) prices performed in the last quarter, it is one of the largest liquidity gainers. Rising prices also drove trading volumes to new levels, subsequently boosting liquidity.

At the same time, Kaiko noted that Ethereum Classic (ETC), Tron (TRX), and Stellar (XLM) rose higher in the rankings.

Feature image from Canva, chart from TradingView

Leave a Reply