As the 2024 Bitcoin halving approaches, investors speculate about the potential impact on Bitcoin’s price due to increased scarcity. Among several methods to predict Bitcoin’s price, the Bitcoin Stock-to-Flow (S2F) model stands out.

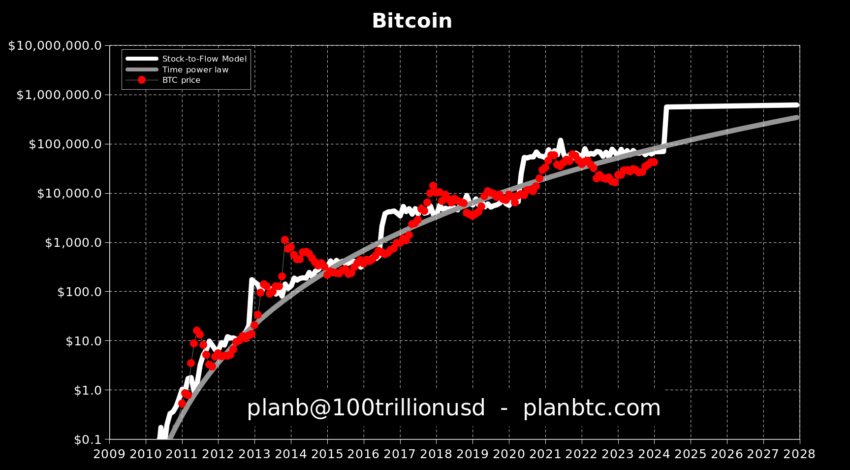

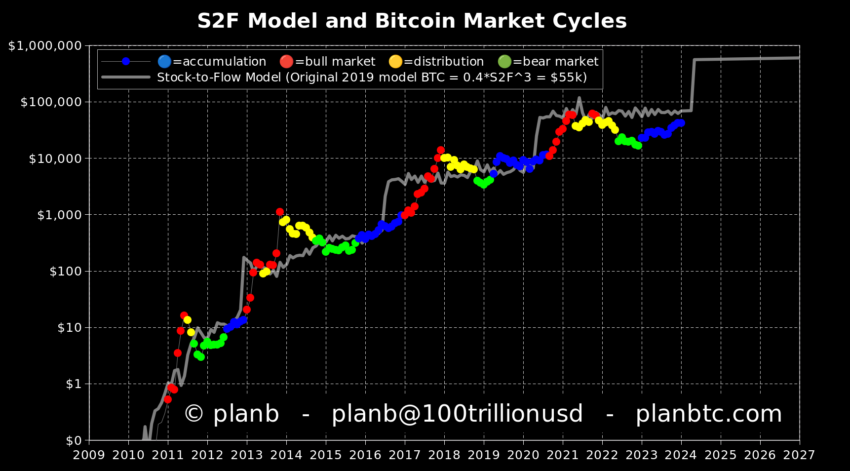

Popularized by X (formerly Twitter) user PlanB, the S2F model draws from traditional stock-to-flow ratios used in commodities markets, such as gold and silver, offering an intriguing forecast for Bitcoin’s future value

A $5 Million Target After the 2028 Bitcoin Halving

The stock-to-flow ratio, a measure of scarcity, is calculated by dividing a commodity’s total amount available by its annual production rate. A higher ratio suggests more scarcity and, consequently, a higher value.

Bitcoin’s unique structure, with a total supply cap of 21 million BTC and a decreasing mining rate due to halvings, presents a fascinating case for the S2F model. Halvings, occurring approximately every four years, halve the rate of new BTC entering circulation. Thus increasing the stock-to-flow ratio and implying an increase in value.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

The application of the S2F model to Bitcoin has been a topic of intense debate. While it aligns with some historical price trends, critics argue it oversimplifies. Therefore, it neglects other market dynamics like demand, technological advancements, regulatory changes, and broader economic factors.

“Stock-to-flow is really not looking good now. I know it’s impolite to gloat and all that, but I think financial models that give people a false sense of certainty and predestination that number-will-go-up are harmful and deserve all the mockery they get,” Ethereum co-founder Vitalik Buterin said.

Despite these criticisms, the S2F model has regained traction, particularly with its prediction following the April 2024 Bitcoin halving of a price surge to $532,400. However, it is the 2028 halving prediction that is capturing headlines.

According to PlanB, the creator of the model, Bitcoin is projected to reach an astonishing $5 million.

“That’s it basically all you need to know, plus a wide error range, of course. By the way, halving 5 – halving 6: average price is $5 million,” PlanB stated.

Read more: Bitcoin Price Prediction 2024/2025/2030

It is crucial to note that financial markets are inherently unpredictable and influenced by various factors beyond scarcity. The S2F model, while insightful, represents one perspective in a wide market. PlanB himself has acknowledged this complexity, recalling past predictions.

“Yes, [risk] margins are wide (-50% +50% in the log), so only directionally and order of magnitude right,” PlanB explained.

The cryptocurrency community remains split as the 2024 Bitcoin halving approaches. While some view the S2F model’s predictions as a beacon of optimism, others caution against relying solely on one model. Therefore, whether the S2F model’s forecast for the 2024 and 2028 Bitcoin halving will materialize remains a speculative yet compelling question.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply