The Bank of Japan (BoJ) has announced it will review plans to roll out a central bank digital currency (CBDC) in the spring of 2024. The move follows several pilots that promise a future for both crypto and digital fiat currency in the nation.

According to an announcement on January 22, 2024, the earliest the central bank could roll out the CBDC would be in 2026. The digital yen has been in the pipeline since its initial pilot in May 2023.

Japan CBDC Pilots at Advanced Stage

The BoJ is currently testing end-to-end CBDC payment flows that involve external system connections. Altogether, the second phase reached transaction speeds of 500-3,000 transactions per second between 100,000 users via five intermediaries.

A central bank digital currency is a blockchain version of currency issued by a government. It allows central banks, retail banks, and retail customers to settle fiat currency transactions faster and quicker than traditional bank rails. Depending on the architecture of the CBDC (several have been proposed and/or implemented), transactions would be recorded and synchronized in real time.

Furthermore, Central banks in the United Arab Emirates, China, Hong Kong, and Thailand have tested a CBDC superhighway called mBridge to link regional banking traffic. Strengthening ties with Russia accelerated China’s ambitions to settle trades on private blockchain infrastructure.

US CBDC News Reveals Different Path to Japan

The topic of a CBDC is increasingly becoming a politically partisan issue on US news. This comes as the primaries kick into high gear. Also, free speech advocates argue that CBDCs lay the groundwork for social scoring systems and government tyranny. In an anti-CBDC bill entitled ABDC Anti-Surveillance Act, Republican Tom Emmer aims to block the US Federal Reserve from unilaterally issuing a CBDC.

Read more: Anonymity vs. Pseudonymity: Understanding the Key Differences

“This bill limits the ability of the Federal Reserve to (1) provide direct services to individuals, and (2) use a central bank digital currency. A central bank digital currency is a digital currency (e.g., Bitcoin or Ether) issued by a government-backed central bank.”

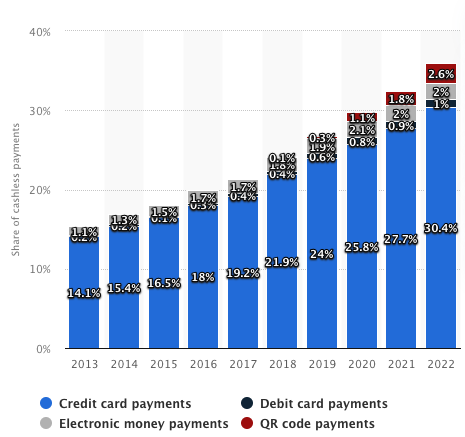

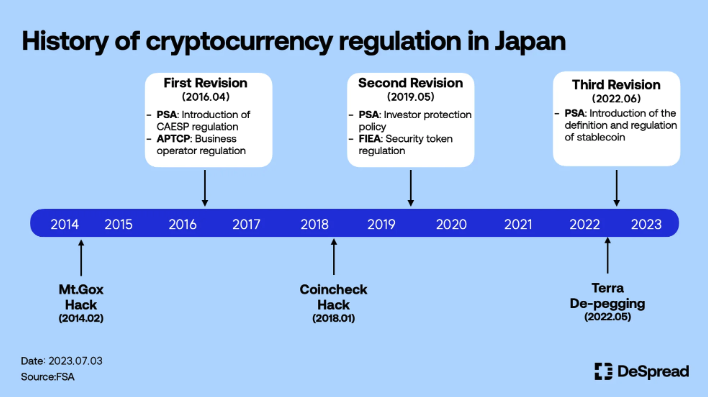

However, the CBDC issue seems less politically charged in Japan, which has one of the oldest crypto regulation frameworks. The government introduced laws after the Bitcoin exchange Mt. Gox collapsed in 2014. Additionally, imminent updates may include legislation to absolve some businesses from paying taxes on crypto holdings.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

Banks in Japan are also fully on board, with several exploring a stablecoin settlement system. In 2023, Mitsubishi UFJ Trust announced a new blockchain system linking several banks, the Japan Exchange Group, and NTT Data.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply