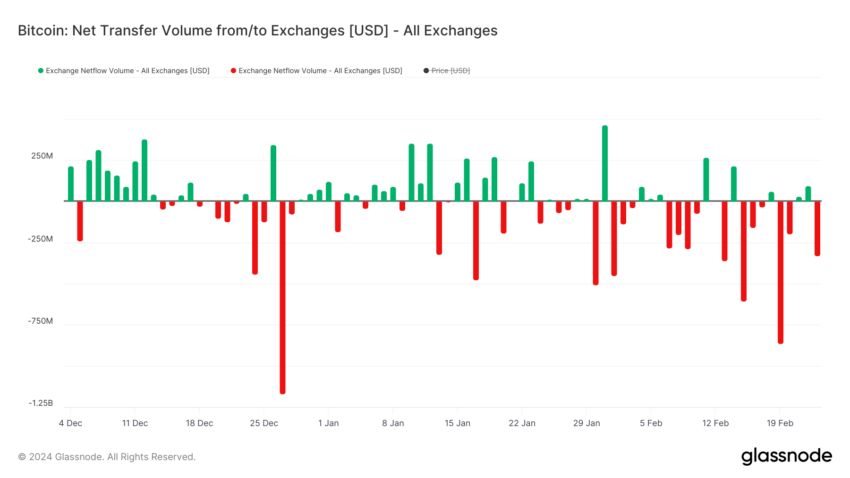

Bitcoin is experiencing a surge in outflows from centralized crypto exchanges, hitting its highest level in eight months, indicating a significant shift in market dynamics.

Interestingly, this trend coincides with a rapid accumulation among crypto whales, pointing towards a transformative phase for Bitcoin’s valuation.

Bitcoin Outflows Hit $540 Million

On-chain data from IntoTheBlock, a prominent market intelligence platform, shows weekly net outflows from centralized exchanges have peaked. Approximately $540 million worth of Bitcoin was withdrawn this week, marking the largest net outflow since June 2023.

Earlier in the week, CryptoQuant’s head of research, Julio Moreno, identified the largest hourly Bitcoin outflow this year from Coinbase. According to him, 18,746 Bitcoin, estimated at $1 billion, were moved in two transactions within the same block.

“The transactions have all the patterns that would suggest: – The Bitcoin is going into custody (input consolidation, new addresses being created with large holdings of 866 or more Bitcoin), or – It is just an internal wallet reorganization. The first option implies institutions buying Bitcoin,” Moreno explained.

The movement of BTC away from centralized exchanges is seen as a bullish sign, indicating reduced availability for sale. Market observers have suggested that the funds are being moved to custodial wallets in anticipation of a price surge, particularly with Bitcoin halving just two months away.

Indeed, the rapid outflow has led to declining Bitcoin balances on major exchanges like Binance and Coinbase. Glassnode data reveals that crypto exchanges now hold only 2.3 million BTC, the lowest level since 2018.

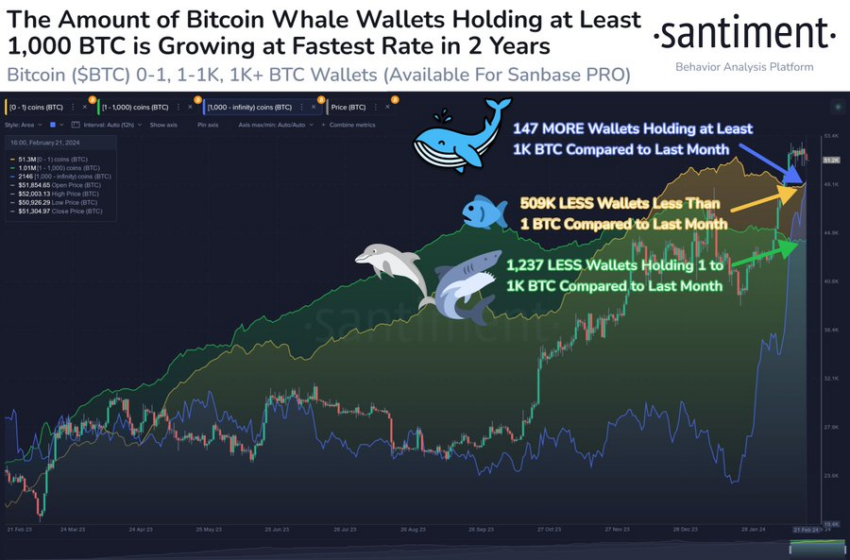

Crypto Whales Accumulate BTC

Meanwhile, crypto whales, holding over 1,000 BTC, are experiencing notable accumulation. On-chain data from Santiment shows a 7.4% increase in these addresses over the past month, with 147 new wallets joining this category, marking the fastest growth in two years.

CryptoQuant corroborates this, noting that the Bitcoin holdings of large entities have surged to the highest level since July 2022, totaling 3.964 million Bitcoin, up from 3.694 million Bitcoin in December 2022.

This surge in crypto whale activity signals a strong vote of confidence in Bitcoin’s future trajectory. Historically, such significant accumulations often precede notable price movements, suggesting the potential for another bullish wave in the market.

“Large entities (1K to 10K Bitcoin) growing their holdings are correlated with higher prices as they denote increasing Bitcoin demand for investment purposes,” CryptoQuant emphasized.

It is worth noting the recently launched spot Bitcoin ETFs in the US are among the large entities buying Bitcoin. These funds now hold nearly 300,000 Bitcoin, emerging as a significant demand source for the top asset.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply