Uniswap, an Ethereum-based decentralized exchange (DEX), stands at the brink of a transformative shift in the decentralized finance (DeFi) sector.

A new governance proposal seeks to redirect protocol fees to UNI token holders, marking a significant stride in democratizing the network.

Snapshot voting indicates overwhelming community backing for the fee reward proposal, slated to conclude by March 7.

The proposal entails upgrading the UniswapV3Factory contract and empowering seamless and programmatic collection of protocol fee revenue. This strategic move aims to fortify the governance framework, endowing UNI token holders with heightened influence over decision-making processes.

“Specifically, we propose to upgrade the protocol such that its fee mechanism rewards UNI token holders that have delegated and staked their tokens,” Erin Koen, Governance Lead at Uniswap Foundation, outlined.

Essentially, the revamped governance structure of Uniswap aims to incentivize active engagement among UNI token holders, thereby bolstering the protocol’s sustainability and fostering its expansion.

Read more: How To Buy Uniswap (UNI) and Everything You Need To Know

At present, unanimous support prevails among voters, with over 10 million UNI tokens pledged to the upgrade.

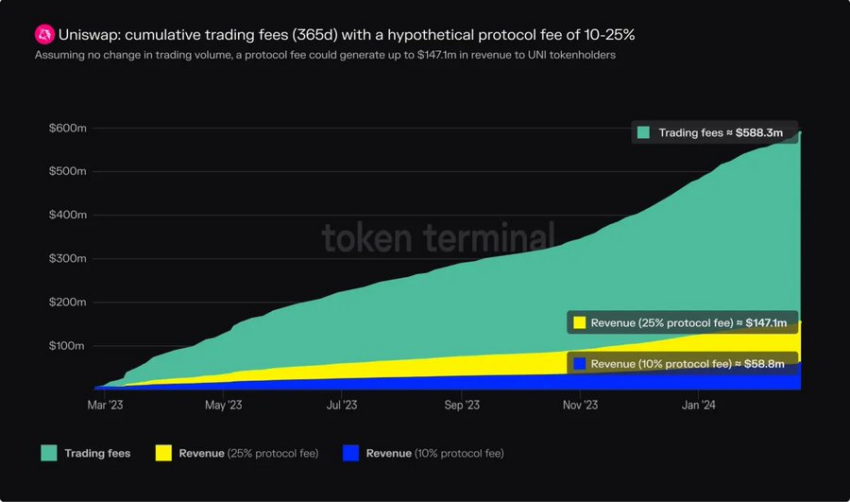

Blockchain analytics firm Token Terminal highlighted the substantial gains UNI holders stand to reap from the proposal. Analysis reveals that, had the fee switch been activated, UNI holders could have accrued as much as $58 million from the $588.3 million in trading fees generated by facilitating $437.7 billion in trading volume over the past year.

“Assuming that a 10% protocol fee gets implemented, Uniswap would become the 9th most revenue-generating protocol in crypto, ranking between Optimism Mainnet and Avalanche,” Token Terminal explained.

However, due to the dormant fee switch, Uniswap has yet to realize revenue from these fees, leaving significant untapped potential.

UNI Price Prediction: Further Upside Potential

UNI’s price has surged in recent weeks, gaining substantial momentum following the introduction of the new governance proposal. Pricing data from BeInCrypto shows Uniswap’s market value has soared by 100% over the past month.

It peaked at over $13 from its previous level below $5, and it currently stands at $12.43, reflecting a slight correction.

Read more: Uniswap (UNI) Price Prediction 2023 / 2025 / 2030

Market analysts attribute this remarkable growth to the prevailing optimism surrounding the fee reward proposal. Notably, one analyst emphasized the pivotal role that the proposed development could play in shaping the token’s trajectory.

“Pretty clean weekly chart. As long as we hold ~$9.8, I will be looking for a break of $13 at some point in the future. This will likely come down to how the proposal surrounding the fee share will go,” analyst DaanCrypto opined .

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply