The dwindling supply of FTM among traders over the last few days signals a noticeable shift towards accumulation by mid-term and long-term holders, suggesting a strengthened belief in FTM’s future prospects.

The FTM price is buoyed by positive market sentiment, with its 7-day RSI indicating high investor interest despite being in the overbought zone. The bullish trend suggested by the Exponential Moving Average (EMA) lines hints at FTM potentially reaching a 2-year high in the near future.

RSI Is at Overbought Levels

The FTM 7-day RSI, a key indicator of whether an asset is overbought or oversold, currently stands at 77, showing a slight decrease from last week’s 81.

This metric, the Relative Strength Index (RSI), measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or asset. Values above 70 typically indicate an asset is overbought and may be due for a price correction.

However, it’s worth noting that, in the past, FTM price has continued to grow for weeks even when the RSI suggested overbought conditions. This demonstrates that while the RSI can signal potential reversals, it does not guarantee them, and market dynamics can sustain price growth beyond traditional technical expectations.

Even with the overbought status, the buyer’s interest can continue growing. Since FTM price is also affected by other variables, like the overall sentiment around the crypto market, it could continue growing despite its RSI 7D above 70.

Read More: Top 5 Yield Farms On Fantom

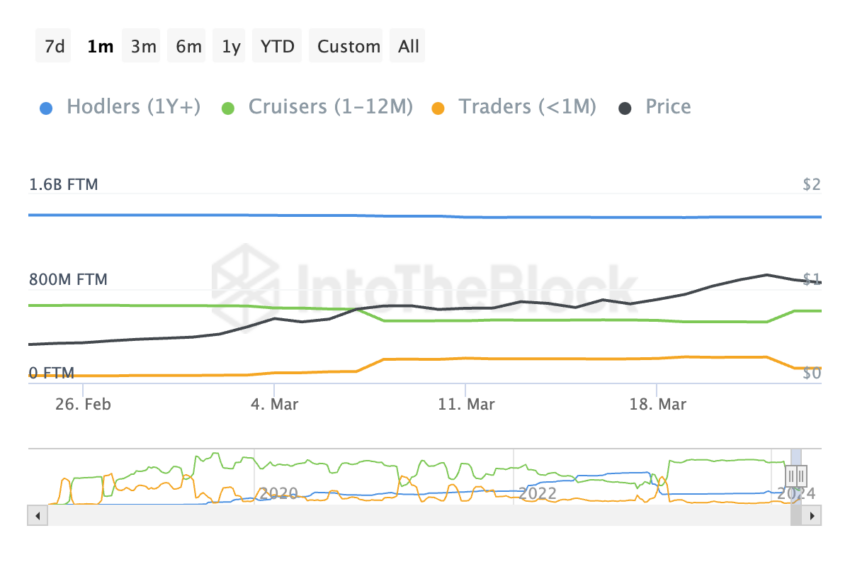

FTM Supply Is Changing Hands

An analysis of FTM token movement between February 24 and March 23 reveals a dynamic shift in investor behavior. This period witnessed a surge in FTM held by Traders, defined as those with a holding period of less than a month. The FTM balance in their hands grew significantly, from 59.8 million to 198.9 million, representing a 232.61% increase.

This influx of traders often coincides with heightened price volatility, and indeed, the price of FTM mirrored this activity, rising from $0.40 to $0.81 within the same timeframe. However, the trend among traders exhibited a shift after March 8. The growth in their FTM holdings continued but at a more moderate pace.

This pattern persisted until March 22, when a noteworthy change materialized. Between March 22 and 23, the supply of FTM in the hands of traders underwent a significant decline, dropping from 217 million to 124 million.

This sudden decrease can likely be attributed to the substantial price appreciation witnessed in the preceding days. Following such a rapid surge, it is a common phenomenon for some investors to capitalize on favorable market conditions. This often involves liquidating their positions and securing profits.

Consequently, this selling pressure from short-term holders likely fueled the observed rise in FTM held by mid-term holders. Their supply increased from 515 million to 608 million. This shift in ownership suggests a potential transition from short-term, profit-driven traders to investors with a longer-term perspective on the FTM ecosystem.

The observed movement could indicate growing confidence in the project’s future potential, with investors adopting a more patient holding strategy.

FTM Price Prediction: Can It Reach a New 2-Year High?

Examining the 4-hour chart for FTM price, the Exponential Moving Averages (EMAs) paint a bullish picture. We see a distinct layering effect, with the shorter-term EMAs positioned above the longer-term ones.

This signifies that recent price action has been dominated by aggressive buyers pushing prices steadily upwards. The shorter-term momentum is clearly leading the charge, further fueling this optimistic outlook.

Adding weight to this bullish narrative is the price action itself. The current price sits comfortably above the key 20 EMA, and support has been repeatedly found near the 50 EMA. This consistent buying pressure and support at these important levels reinforces the notion that bulls are in control.

Read More: 9 Best Fantom (FTM) Wallets in 2024

Should this momentum continue and the price manage to break decisively through the $1.22 resistance level, a significant price advance could be on the cards.

A potential surge towards $1.50, a level unseen since late March 2022, becomes a realistic possibility. However, if a downtrend occurs, FTM could drop to $0.70 or even below $0.60 soon.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply