April is expected to be a big one for the crypto market as a major event in the Bitcoin (BTC) halving is scheduled. This will also have an impact on other assets, such as Solana (SOL) and Fantom (FTM).

BeInCrypto looks at the ongoing market movements and where you can expect these assets to land.

Bitcoin Will Likely Climb to $77,000

Bitcoin price marked a fresh all-time high of $73,750 earlier this month, and since then, the cryptocurrency has been on a decline. This resulted in the cryptocurrency forming a flag pattern on the 4-hour chart. The cryptocurrency broke out of the pattern earlier this week and is presently trading at $70,151.

Per the bullish flag pattern, the target price is set at almost $77,000, which will be achieved as long as the $69,715 support line is sustained.

This outcome is very likely since Bitcoin halving is scheduled to take place on April 22. The anticipation ahead of the event will drive prices higher, potentially validating the pattern as well.

Read More: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

However, if the support of $69,715 is lost, there is a good chance Bitcoin price could slip back to $66,500, effectively invalidating the bullish thesis.

Solana (SOL) to Make It Big Thanks to Two Major Factors

Solana’s price is among the best-performing cryptocurrencies in the market at the moment, and this growth is only going to snowball in April. The reason behind this is the support SOL is receiving from institutional investors.

Per the CoinShares weekly netflows report, Solana outperformed every other altcoin, including Ethereum, to emerge as the institution’s preferred asset, noting $18 million worth of inflows this month.

Additionally, Solana-based DEX Jupiter performed exceptionally this month. The decentralized exchange rose to become the biggest DEX in the market based on volume, pushing the monthly DEX total transaction volume to a new all-time high of $241.97 billion.

Thus, Solana’s price will likely witness the influence of these developments to propel itself beyond $200. Furthermore, SOL is already testing the 61.8% Fibonacci Retracement as support, which is also known as the bull run support floor.

This could push the altcoin to note a 35.88% rally and tag the resistance at $250.

Read More: 13 Best Solana Meme Coins to Watch in 2024

Nevertheless, losing the $186 support floor could cause a decline to $164, essentially eliminating the possibility of a rally.

Fantom (FTM) Will Take the Bearish Route

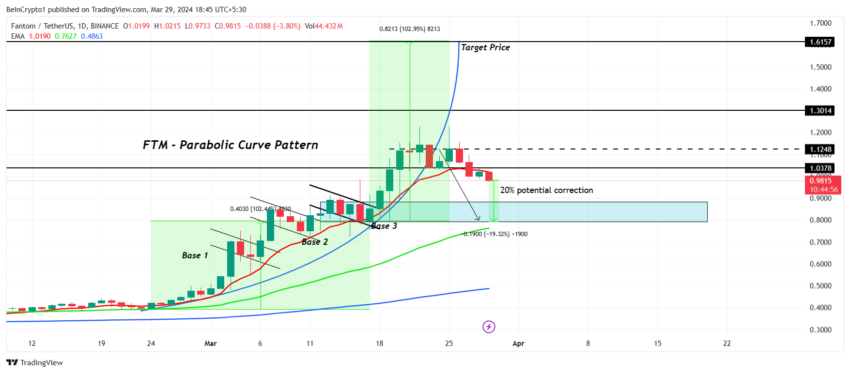

Fantom price is not expected to rise in the coming month, unlike the rest of the assets on this list. The reason behind this is that FTM is poised for a 20% correction according to the parabolic curve pattern.

Per the pattern, a drawdown to the base 3 price level is expected, given FTM failed to breach the $1.12 resistance.

Substantiating this outcome are the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These indicators highlight bearishness taking precedence, with the latter noting a bearish crossover for the first time in two months.

Thus, FTM will probably witness a drawdown where it will lose the $0.80 support and decline further.

Read More: 9 Best Fantom (FTM) Wallets in 2024

However, should Fantom’s price bounce back from the base 3 support range, it would have a shot at invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply