A substantial amount of Bitcoin (BTC) and Ethereum (ETH) options will expire on April 12, 2024. The notional value of 21,000 BTC contracts and 230,000 ETH contracts expiring soon is $1.5 billion and $800 million, respectively.

How might the expiration lead to more volatility in the market and impact the prices of Bitcoin and Ethereum?

Has Volatility Returned to the Crypto Market?

According to Greeks.live, the BTC put-to-call ratio is 0.62. The maximum pain point — the price at which the asset will cause financial losses to the largest number of holders — is $69,000.

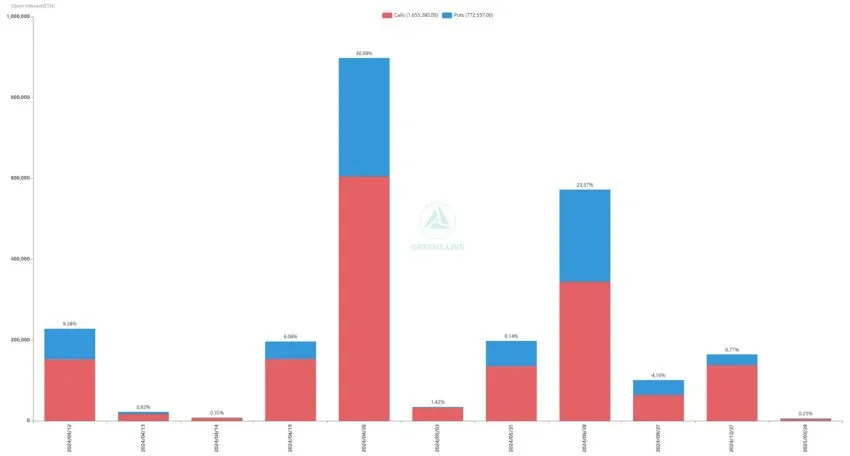

Meanwhile, the put-to-call ratio on Ethereum is 0.49, and the maximum pain point for ETH is $3,425.

Read more: An Introduction to Crypto Options Trading

Analysts at Greeks.live have noted a marked increase in volatility within the crypto market this week. The balance is between $70,000 for Bitcoin and $3,500 for Ethereum. Short calls are emerging as the most dominant trade of the month.

Furthermore, the halving event has surpassed expectations.

“Given the recent slowdown in ETF inflows and more subdued sentiment, selling in the medium term is indeed the best option, and in the short term, it is worth doing as the halving approaches,” the analysts commented.

Bitcoin has shown significant volatility this week, with the asset price falling below $66,000 and rising above $72,000. At the time of writing, BTC is trading at $70,900.

Crypto options are derivative contracts allowing traders to buy or sell an asset at a specific price on a particular expiration date. If the option owner decides not to buy or sell crypto, they are not obligated to do so. This makes options more flexible than futures, which require you to close a position regardless of profit or loss.

Read more: 9 Best Crypto Options Trading Platforms

It is quite difficult to predict how the market will behave on the expiration day of many contracts, especially if any events that affect the news background are added. However, crypto traders and investors must closely monitor the situation to ensure that increased volatility does not lead to unwanted stop-loss orders or poor trading decisions.

Investors should remember that the impact of option expiration on the underlying asset’s price is short-term. As a rule, the next day, the market will return to its normal state, and strong price deviations will be compensated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply