Bitcoin’s (BTC) price is likely in the middle of a bull run, and it could continue the rally following the halving event.

This is further substantiated by the investors holding on to their BTC, which is a testament to their conviction, stronger than in 2021.

Bitcoin Investors Show Confidence

After posting a new all-time high this month, Bitcoin’s price halted the rally as the market cooled down. While many considered this to indicate a market top, this may be its mid-point. The reason behind this is the conviction shown by investors.

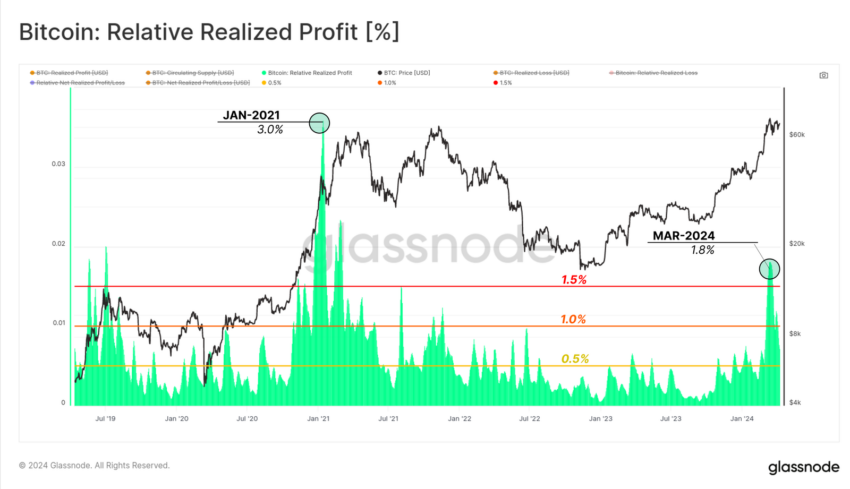

This is evident from the Relative Realized Profits. Comparing the present bull cycle’s profit-taking to the 2021 cycle’s, it becomes evident that investors are much more anchored this time around. In 2021, around the all-time high of $64,500, the realized profits were at 3%.

However, at the moment, the same metric is peaking at 1.8%. This suggests that 1.8% of the market cap was locked in as profit over a seven-day period. Investors have not been selling their holdings as much as they did back in 2021, showing conviction.

Read More: What Happened at the Last Bitcoin Halving? Predictions for 2024

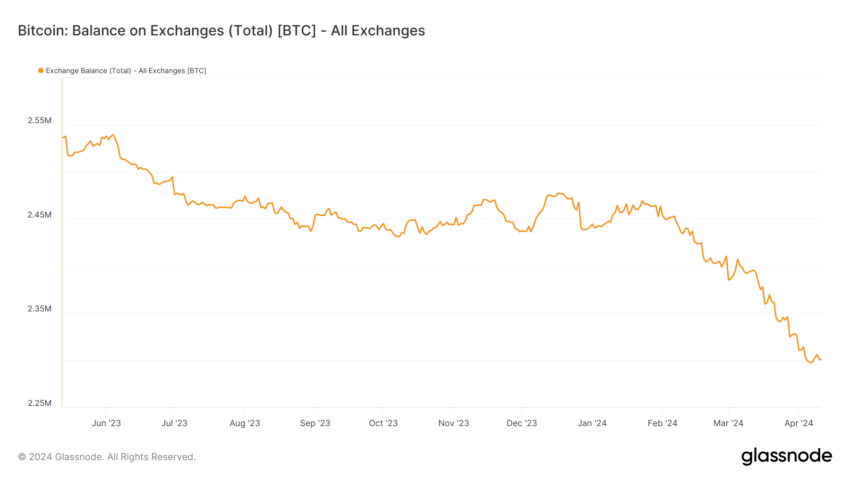

This is supported by the consistent accumulation noted since February. Investors have been majorly adding to their wallets, and in the last 11 days of April alone, over 10,284 BTC worth over $728 million have been bought from exchanges.

Accumulation indicates confidence among investors as it shows that they are expecting further price growth. This sentiment will likely be validated as the bullish halving event takes place.

BTC Price Prediction: Rally Awaits

Bitcoin’s price over a 3-day timeframe validates a Wyckoff pattern. The Wyckoff pattern is a trading method that analyzes market trends, volume, and price action to identify accumulation and distribution phases.

Read More: 7 Best Bitcoin Halving Promotions to Check Out in 2024

However, if Bitcoin’s price falls below this support level, a decline could be observed to $63,159. Losing this support floor would invalidate the bullish thesis, resulting in a correction to $60,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply