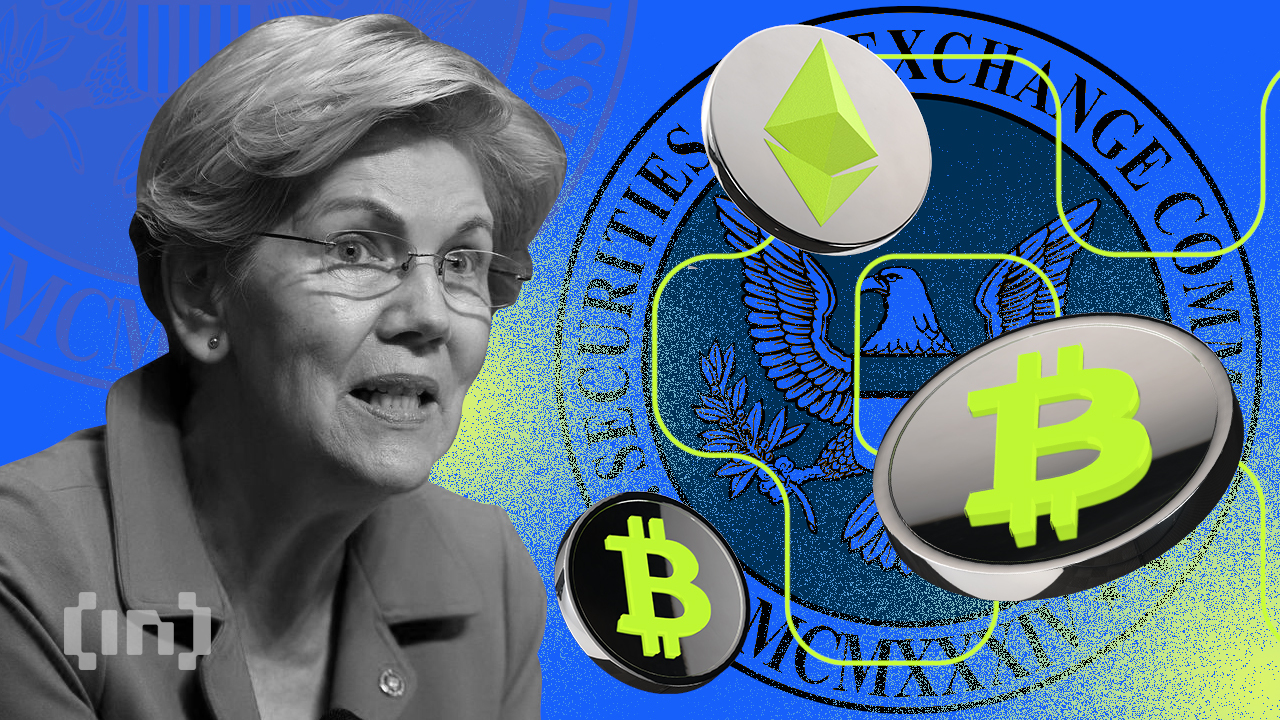

In an intriguing twist of her political trajectory, Senator Elizabeth Warren, known for her aversion to cryptos, has focused on the practices of tech mogul Elon Musk.

Known as the world’s wealthiest man, Musk’s recent management decisions have drawn the ire of the Massachusetts senator. It set the stage for her recent call to the Securities and Exchange Commission (SEC) to investigate Musk’s alleged conflicts of interest at Tesla and Twitter.

Senator Elizabeth Warren Goes After Elon Musk

Senator Elizabeth Warren is concerned that Elon Musk’s extensive workload could be detrimental to shareholders’ interests. Her argument revolves around Musk’s simultaneous roles as CEO of both Twitter and Tesla.

The American politician argues this dual responsibility has raised serious concerns about conflicts of interest. It could lead to a potential misuse of corporate assets, and negative impacts on Tesla shareholders.

“Though Mr. Musk recently announced the hiring of Linda Yaccarino as the new CEO of Twitter, this does little to address the concerns to Tesla and its shareholders related to his dual role. Despite hiring Ms. Yaccarino, he is likely to retain ‘significant control’ over the company and intends to continue overseeing core functions of the business,” said Warren.

Indeed, Warren’s indignation is fueled by what she sees as Tesla’s board of directors’ failure to address these issues. She asserts that the board has not adequately informed shareholders about Musk’s questionable capacity.

In her letter to the SEC, Warren requested an examination of how Tesla’s board of directors managed “the apparent conflicts of its CEO, Elon Musk.”

“Inevitable conflicts of interest arising from, for example, Twitter’s reliance on advertising revenue from automobile companies that are in direct competition with Tesla, including Audi, Chevrolet, Ford, GM, Jeep, and Volkswagen… Mr. Musk could run Twitter to benefit Tesla through favorable algorithms or free advertising,” said Warren.

Investors have been allegedly left in the dark, undermining their ability to make informed voting and investing decisions. Even Cathie Wood revealed that ARK Investment Management reduced its holdings in Twitter by 47% since Musk took over the social media giant.

Meanwhile, Oppenheimer & Co. downgraded its rating on Tesla. The decision came after Elon Musk’s decision to purchase Twitter, which was followed by a 58% plunge in Tesla’s stock

“We believe Mr. Musk is increasingly isolated as the steward of Twitter’s finances with his user management on the platform. We see potential for a negative feedback loop from departure of Twitter advertisers and users,” said Colin Rusch, an analyst at Oppenheimer.

Championing Financial Accountability

The twist in the senator’s narrative comes from her previous focus on cryptocurrency regulation, particularly in her “anti-crypto” stance. Warren had previously argued that the lack of regulations and the potential for fraud made the crypto industry a threat.

“Crypto is helping fund the fentanyl trade, and we have the power to shut that down. It’s time,” said Warren.

Her decision to shift her attention from the crypto to the world’s richest man is seen as a dramatic repositioning.

Still, this shift does not suggest softening her views on crypto. Rather, it appears to expand her focus to include any financial entities or individuals she perceives to be acting contrary to the public’s best interest.

Read more: Warren Calls on All Regulators to Rein in Crypto

As Warren prepares for another Senate term, she continues to leverage her reputation for championing corporate governance and regulation. From her anti-crypto stance to her current anti-Musk campaign, Warren underscores her role as a watchdog of financial accountability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply