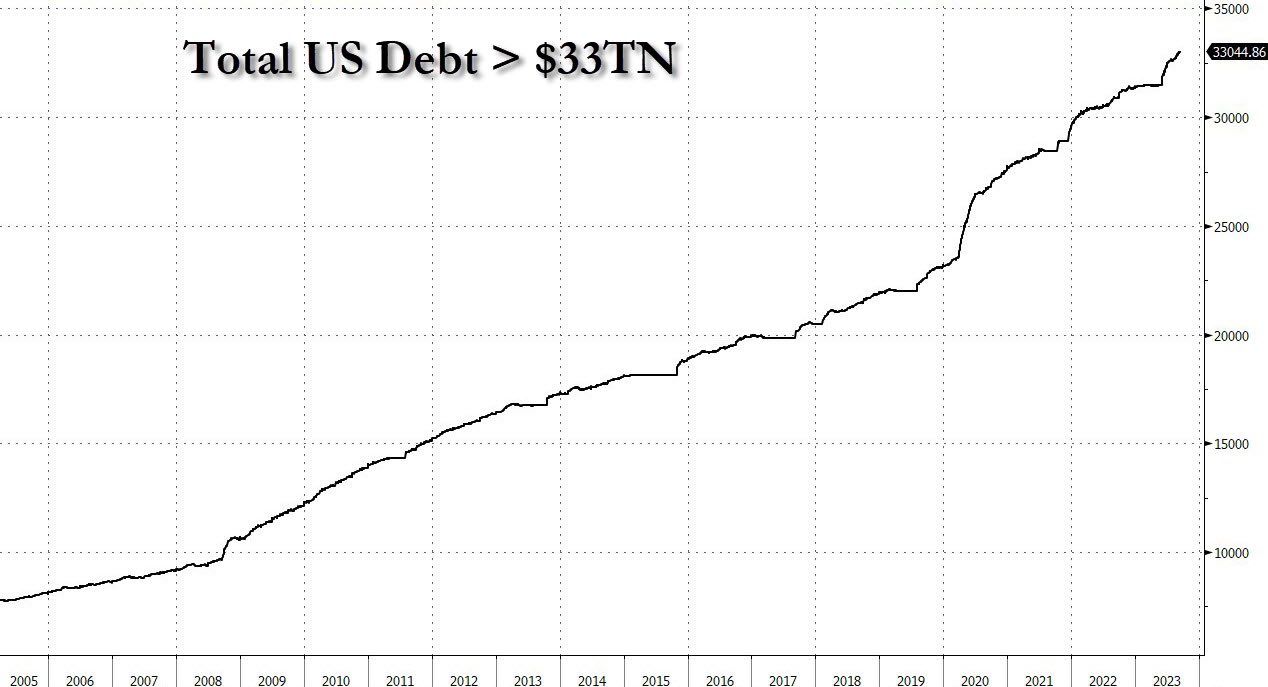

America’s epic debt problem is not going away as surging interest rates pile more pressure on the economy. As a result, the national debt in the United States has skyrocketed to record levels.

For the first time in history, total US Federal debt has exceeded $33 trillion, reported The Kobeissi Letter on September 19.

National Debt Skyrockets

President of the Committee for a Responsible Federal Budget, Maya MacGuineas, said:

“The United States has hit a new milestone that no one will be proud of: our gross national debt just surpassed $33 trillion,”

The macroeconomic analysis outlet added that the US government had added $1 trillion in debt per month since the debt ceiling “crisis.”

On June 3, President Joe Biden approved a bill that removed the government’s multi-trillion dollar debt ceiling, allowing more debt to be piled on. Moreover, the debt ceiling is currently uncapped until January 2025.

Additionally, the US has added a total of $11.5 trillion in debt over the past five years. At the same time, the country is on track for $1 trillion in annual interest expenses, the Kobeissi Letter added.

“Interest will soon be the US government’s biggest expense. How can this end well?”

At the current pace, the US will pass $50 trillion in debt well before the end of the decade.

The real-time US debt clock website puts the actual figure at $33.04 trillion. Comparatively, the entire crypto market is worth just $1.1 trillion. By 2027, the counter estimates a national debt figure of $45 trillion.

Furthermore, the US federal debt to GDP ratio is currently 122.4%, according to the debt clock.

However, Treasury Secretary Janet Yellen doesn’t seem too worried about the frightening figures. She told CNBC on Monday,

“The statistic or metric that I look at most often to judge our fiscal course is net interest as a share of GDP.”

This refers to the net payments the federal government makes on its debt relative to gross domestic product.

However, Mark Spitznagel, founder of the hedge fund Universa Investments, warned that we are in the “greatest credit bubble in human history.”

“We’ve never seen anything like this level of total debt and leverage in the system. It’s an experiment,” he said before adding:

“But we know that credit bubbles have to pop. We don’t know when, but we know they have to.”

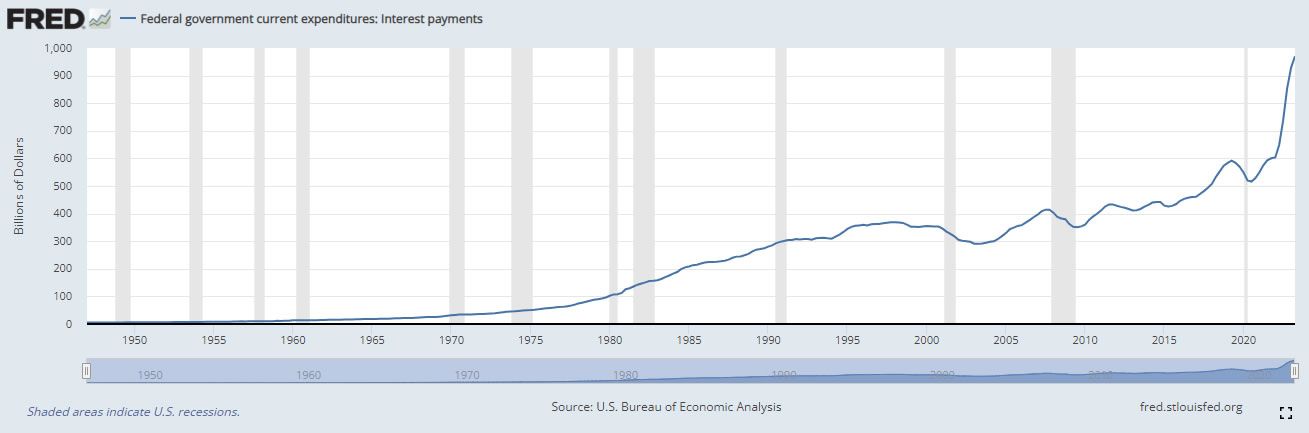

Interest Payments Skyrocketing

According to the St. Louis Fed, government expenditures in interest payments alone had surged to almost $1 trillion at the end of Q2 when the last figures were included.

Over the past three years, government interest payments have almost doubled.

On Monday, BeInCrypto reported that personal interest payments had reached a record $506 billion in July. This is a staggering 80% increase since 2021 due to rising interest rates, which are currently 5.5%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply