- Robert Kiyosaki challenges the 60/40 investment strategy that has 60% stocks and 40% bonds.

- He says a portfolio with 75% gold, silver Bitcoin mixed 25% real estate/oil is better.

- Investors might want to shift if they want to survive an imminent economic crash of historic proportions.

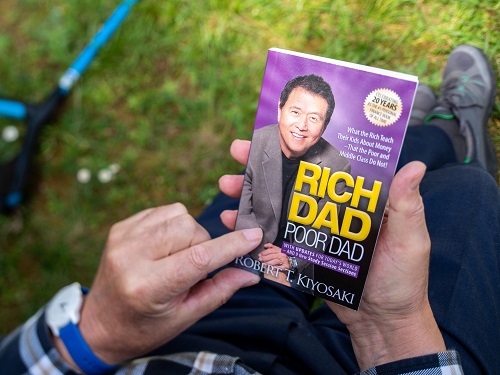

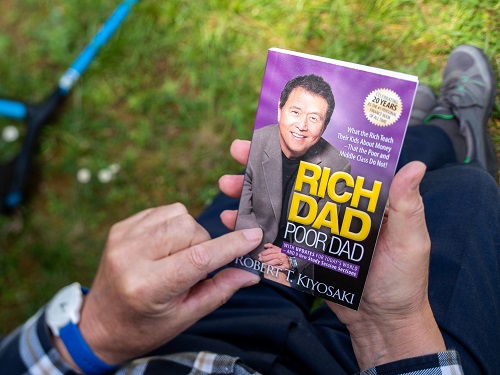

Robert Kiyosaki, a renowned author and entrepreneur, says the current market is not one where the traditional 60/40 investment advice works.

Financial experts have for ages talked about having 60% of one’s portfolio in stocks and 40% in bonds. But according to Rich Dad Poor Dad author, those who take this approach to portfolio allocation are “the biggest of losers.”

Gold, silver and Bitcoin

Rather than the 60/40 strategy, Kiyosaki suggests putting 75% of the investment in gold, silver and Bitcoin, and 25% in real estate or oil. Such a portfolio might survive a global crash.

“Forever and ever financial experts have promoted the idea “Smart Investors invest in 60/40 60% bonds 40% stocks. In 2024 60/40 investors will be biggest losers. Before going down with the ship consider a shift to 75% Gold, Silver, Bitcoin 25% real estate/oil stocks. This mix may allow you to survive the greatest crash in world history,” he said in an October 29 post on X.

In another post last week, Kiyosaki noted that his first gold coin cost him $40 – today it’s worth $2,000. Rather than wanting to be like the Oracle of Omaha Warren Buffett, he opined that “Dollar Cost Averaging” was what average investors should go for when looking to accumulate assets.

Gold dropped $10 today. Silver 14 cents. This is where “Dollar Cost Averaging” pays off. Rather than pretend to be Warren Buffet picking bottoms I am an average investor “accumulating” the asset I want for the long term. I have been accumating gold, silver, BC and real estate…

— Robert Kiyosaki (@theRealKiyosaki) October 23, 2023

The investor’s latest take on investing comes as the Bitcoin price hovered above $34,000. The benchmark crypto asset is forecast to embark on a new bull market that could take its price to highs of $125k in 2024.

Currently, bulls are looking to retest resistance above $35k, with analysts saying investors could be watching for volatility amid an upcoming Fed meeting and the unfolding geo-political landscape.

Leave a Reply