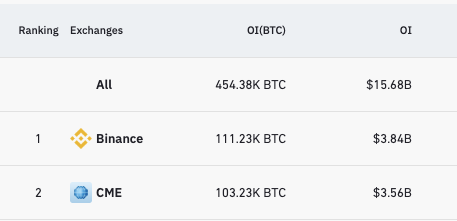

Chicago Mercantile Exchange (CME) is about to have a large position with Bitcoin futures open interest over major crypto exchange Binance, according to VanEck strategy advisor Gabor Gurbac.

“CME is about to flip Binance as the largest exchange with respect to Bitcoin futures open interest,” Gurbac stated.

Gurbac Sees the Crypto Market in Its Inceptive Phase

In a series of posts on X (formerly Twitter), Gurbac shed light on the escalating open interest in Bitcoin futures on CME in relation to Binance.

CME has 103.23K Bitcoin in open interest, while Binance has 111.23K BTC in open interest.

Gurbac points to the small gap in the pair as a sign that other markets may catch up as well:

“Institutions are here… and it’s just getting started. The physical markets will catch up.”

At the time of publication, Bitcoin’s price stands at $34,502.

Gurbac recalls filing for VanEck’s first-ever Bitcoin futures ETF as having difficulty explaining it to United States regulators.

“I’ll never forget the ~30 regulators at the SEC probably thinking I was high.”

However, a reply from an X user suggested that there are additional factors that should be taken into account:

“I think CME’s rise underscores institutional gravitation to Bitcoin futures. Yet, it’s crucial to observe the holistic health of secondary markets and potential impacts on price discovery mechanisms.”

Learn more: How To Trade Bitcoin Futures and Options Like a Pro

Recent Speculation Over Spot Bitcoin ETFs

Recently, the crypto industry has generated significant speculation regarding the approval of a spot Bitcoin ETF in the US.

Recent survey findings show that about 64% of respondents intended to adopt a long-term holding strategy for Bitcoin in anticipation of a spot Bitcoin ETF.

Meanwhile, several analysts predict that the approval of a spot Bitcoin ETF will yield favorable outcomes for investors.

On September 11, BeInCrypto reported Vetle Lunde, a senior analyst at K33 Research, suggesting that investors should seize the opportunity to acquire Bitcoin at its current price during the period of uncertainty surrounding approval decisions.

“I firmly believe the market is wrong. This is, by all accounts, a buyer’s market, and it is reckless not to aggressively accumulate BTC at current levels.”

Learn More: How To Open a Bitcoin Account in 3 Easy Steps

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply