India’s crypto market has gone through a significant shake-up in the past few years. A market downturn that coincided with global financial uncertainties led to lawmakers tightening the screws on taxes and regulations.

As India braces for the presentation of the interim budget in Parliament on February 1, the air is thick with anticipation and apprehension.

Will India Cut Back Its Crypto Tax?

Crypto investors and exchange owners faced a challenging year in 2023. Many are voicing a strong demand for reduced tax rates on crypto assets. Their eyes are set on the country’s 2024 budget, looking for a glimmer of hope in a sector mired in regulatory uncertainty.

However, the government’s stance appears unyielding. Expectations lean towards the government not only withholding relief but also contemplating heightened restrictions.

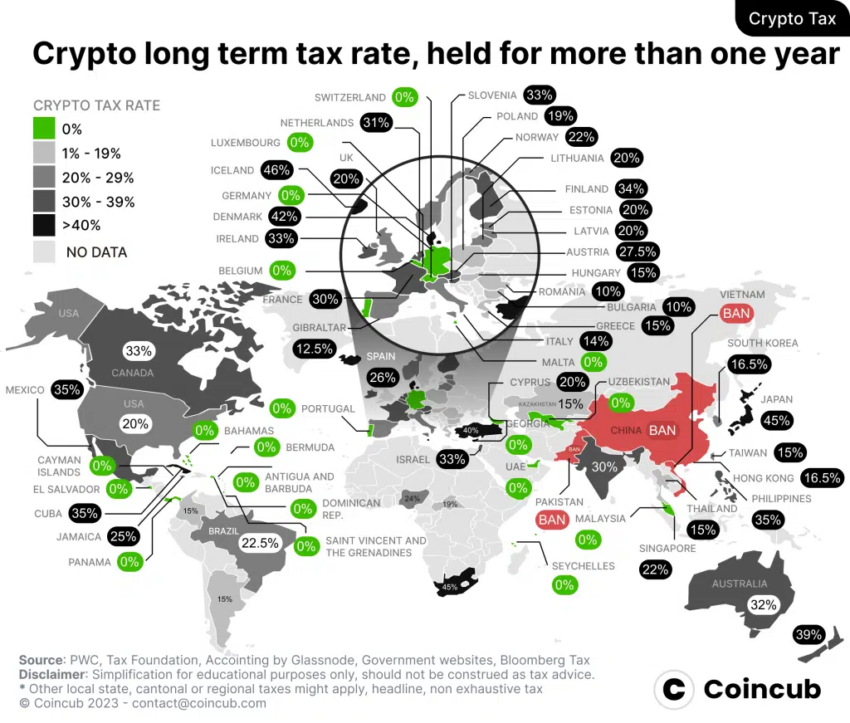

A looming possibility of a complete ban on private cryptocurrencies also adds to the industry’s woes. The previous budget, spearheaded by Finance Minister Nirmala Sitharaman, maintained a flat 30% tax on virtual assets.

This was a move that was less than well-received by the industry. To add to the burden, an additional 1% Tax Deducted at Source (TDS) was imposed on all crypto transactions, further straining the sector.

India & Global Partnerships head at Liminal Custody Solutions’ Manhar Garegrat, views the 2024 budget as a crucial turning point. He asserted:

“Unlocking the full potential of this transformative asset class demands a robust ecosystem built on clarity, innovation, and talent.”

Garegrat emphasizes the need for clarity in the definitions of virtual digital assets (VDAs), tokenization, and the removal of the 1% TDS on overseas crypto assets. He also underscores the importance of prioritizing research and development for web3 projects.

Read more: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

Investors Want Less Tax and Sensible Regulations

The industry’s plea is clear: a reduction in tax rates and a more comprehensive policy on cryptocurrency regulation. The current broad definition of VDAs needs refinement to foster a dynamic and inclusive digital asset ecosystem.

Garegrat suggests refining VDA definitions to exclude valuable tokenized assets as a positive step forward.

The introduction of the 1% TDS in 2022 is believed to have caused an estimated loss of $420 million in potential government revenue. This has forced many Indian crypto traders to migrate to overseas platforms.

Garegrat proposes tax breaks for the development of blockchain security infrastructure and the implementation of advanced security protocols. These measures could attract investment, generate high-skilled jobs, and solidify India’s position as a global leader in secure digital asset custody.

So, as India navigates the choppy waters of cryptocurrency regulation, its 2024 budget stands as a pivotal moment. Will it offer a beacon of hope to rejuvenate the industry or tighten the leash, further constraining an already embattled sector?

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

Leave a Reply