Nigeria’s House of Representatives on Financial Crimes demands that Binance CEO Richard Teng defend $26 billion in alleged illegal flows on its local peer-to-peer (P2P) exchange. The summons follows government moves to eliminate parallel forex markets that create confusion about the Nigerian currency’s strength.

The Nigerian government has asked Richard Teng to appear before them following the detention of two executives amid a broader crackdown on crypto exchanges.

Nigeria Slams Binance CEO’s Apathy

The Nigerian government says that Teng must appear before them to answer for an alleged $26 billion in illegal fund flows. They say Teng has repeatedly avoided meetings and that refusing to respond to the latest summons will result in litigation against the exchange.

According to Ginger Owusibe, Binance cannot continue exploiting customers without accountability. The grace period for unchallenged operations is over.

“You cannot run a company with over 10 million Nigerians on your platform without paying tax and having a physical office where Nigerians can lodge their complaints when they experience any challenge with your service. The era of exploitation is over, and all culprits must be held accountable,” Onwusibe said.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Teng, a former central banking employee, took control of Binance after the exchange was fined for money laundering violations and its former CEO Changpeng Zhao pleaded guilty to money laundering. Teng took over as part of the deal to allow the exchange to continue operating. Zhao is in the United States, having been denied leave to return to his home in the United Arab Emirates.

Nigeria’s summons comes amid a difficult transition period for Binance. In addition to Zhao’s plea deal, the crypto exchange must allow deeper oversight of its operations to continue functioning. It recently lost several executives, including a counter-terrorism executive, before the US crackdown.

Binance Crackdown Part of Broader Reforms

Following his election in mid-2023, Nigerian President Bola Tinumbu appointed introduced reforms to financial markets. In February, the central bank confirmed revising its fiat currency exchange rate calculations to remedy foreign investor concerns.

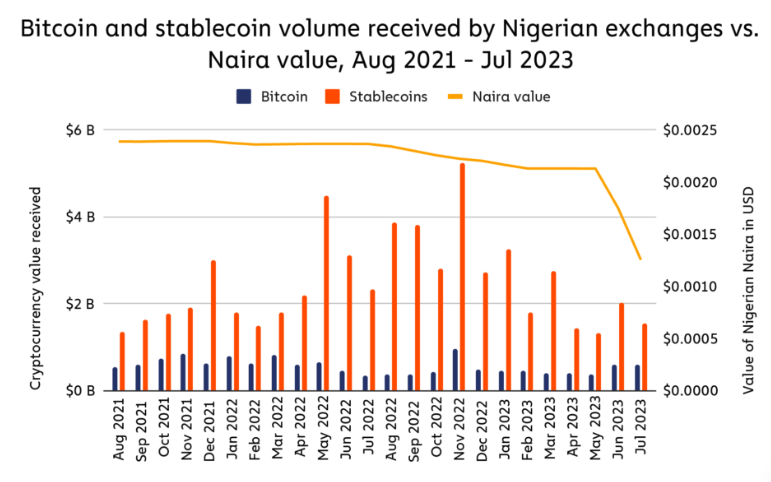

As part of these reforms, authorities identified Binance P2P Nigeria and other exchanges as sources of naira weakness. They said Binance had allowed criminals to weaken the naira through parallel crypto forex trading in defiance of local regulations.

Authorities later detained two Binance executives, which prompted the exchange to halt naira trading in Bitcoin and Tether. An investigation by Nigeria’s anti-corruption agency, police, and national security adviser also found Binance processed $26 billion in flows from sources the government “cannot adequately identify.”

Read more: Cryptocurrency Regulation in Africa: What We Know So Far

BeInCrypto contacted Teng on LinkedIn regarding the allegations but had yet to hear back at press time. As of November last year, the executive was believed to reside in Abu Dhabi.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply