Binance Labs will invest in seven of the twelve candidates participating in its 2023 incubator program. Projects like the Ethena Protocol, NFPrompt, and others will receive mentorship and funding from the Binance Labs team.

Binance will fund and work with DeFi projects Ethena, Derivio, Shogun, UXUY, Cellula, and artificial intelligence endeavors NFPrompt and QnA3. The selection of these projects concludes Binance Labs Incubation Season 6.

How Binance Incubator Unfolded

Binance launched Incubation Season 6 in September last year. Its incubator sought promising inventions in DeFi, Web3, and artificial intelligence. A successful pitch would see these endeavors receive backing from the Binance investment team.

Twelve organizations participated in the round, including DeFi protocols and some innovators combining AI and blockchain. There were seven selected, most of which are novel decentralized finance projects.

Following the incubation period, Binance Labs head and Binance co-founder Hi Ye said the firm’s goal is to support new projects with a long-term plan. She added that the company supports efforts across all chains.

“At Binance Labs, our goal is to support and back serious early-stage founders. Our support extends across all chains and ecosystems for projects that are committed to long-term development across various sectors. We look forward to seeing each project’s continued growth and contribution to the Web3 ecosystem,” Ye wrote.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

Binance invited developers to pitch their offerings to investors and conscientize attendees to their latest innovations at the Binance Blockchain Week in Istanbul. Companies attending included Chiliz, Animoca Brands, and Trust Wallet.

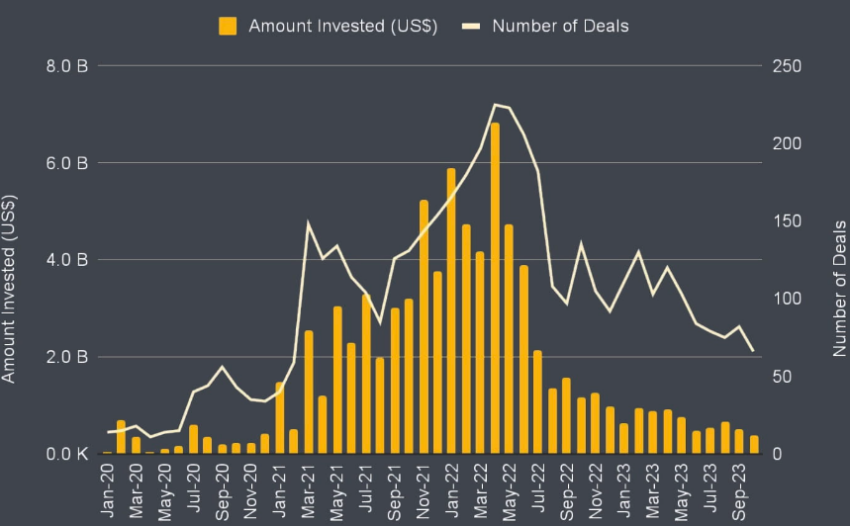

How Investments Have Fared

Some of the projects that Binance has supported have fared well since then. The Ethena Protocol has accrued over $700 million in total value locked. Bitcoin staking protocol Babylon, which Binance invested in previously, has been integrated into the Cosmos Hub, which has a stake of $2.5 billion.

However, the investments could also be a double-edged sword. Earlier this year, the exchange’s Ronin (RON) token listing was allegedly marred by insider trading that saw investors sell off a huge chunk of the token’s supply. At the time, Hi Ye acknowledged that the firm would strengthen management and delay listing tokens if information was accidentally leaked through business relations.

“If you verify that Binance team members are corrupt, we will keep your identity confidential and provide you with a security vulnerability bonus of US$10,000 to US$5 million,” Ye said.

Read more: 7 Best Binance Alternatives in 2024

BeInCrypto contacted the Ethena Labs and NFPrompt for comment but has not heard back at press time. Requests sent to Binance also went unanswered.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply