Key Takeaways

- Bitcoin surged above $45,000 Wednesday.

- The bullish price action signals a potential trend reversal.

- Breaking $48,250 could send BTC towards $56,000.

Share this article

Bitcoin is back in the spotlight after gaining more than 20% in market value over the last three days. Further upward pressure may have the strength to kick start a new uptrend.

Bitcoin Regains Lost Ground

Bitcoin continues trending upwards, signaling the possible beginning of a new uptrend.

The flagship cryptocurrency is on the rise as the buying pressure behind it increases. Prices surged to an intraday high of $45,350 at press time, following three days of upward momentum. While global markets remain on shaky grounds, it appears that Bitcoin could be heading to greener pastures.

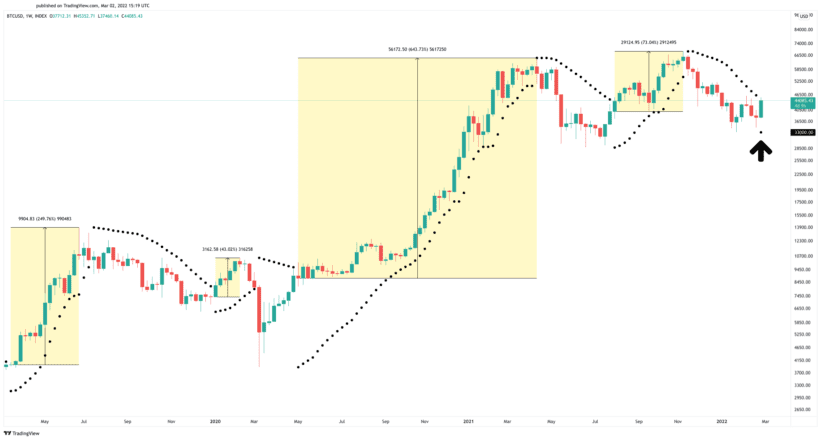

The parabolic SAR suggests the downtrend BTC has been trapped in since early November 2021 may have reached exhaustion. The stop and reversal points moved below the price of Bitcoin on the weekly chart, which is considered to be a positive sign. The recent flip indicates that the direction of the trend changed from bearish to bullish.

Historically, parabolic SAR has been highly effective in determining the course of Bitcoin’s price. The last four times the stop and reversal system flipped from bearish to bullish on the weekly chart, BTC’s price surged by 73%, 644%, 43%, and 250%, respectively.

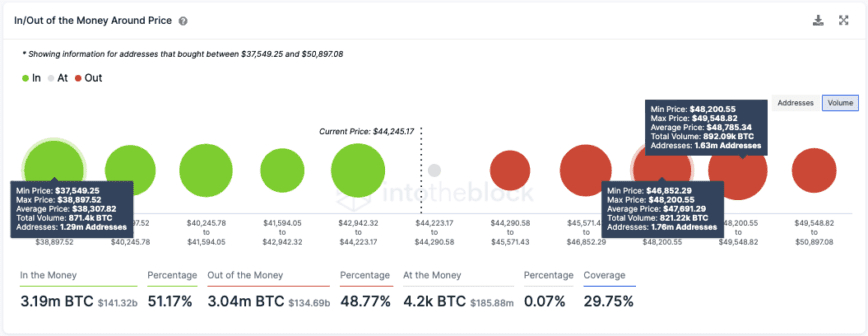

Even though the odds appear to favor the bulls, IntoTheBlock’s IOMAP reveals that the top cryptocurrency may still face stiff resistance ahead.

Nearly 3.40 million addresses had previously purchased more than 1.71 million BTC between $47,000 and $49,500. Given the significance of this supply wall, traders may need to wait for a decisive weekly close above it to confirm the optimistic outlook. Breaking through the $48,250 barrier could then propel Bitcoin towards $56,000.

It is worth noting that Bitcoin must remain trading above $38,300 for the bullish thesis to prevail. Failing to hold above this support level could trigger a sell-off that sends prices back towards $30,000.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

As Sanctions Pile, Bitcoin Flips the Russian Ruble

Thanks to unprecedented financial sanctions from the West, Bitcoin now has a higher market capitalization than the Russian ruble. Russian Ruble Plummets Following Western Sanctions Bitcoin has flipped the Russian…

Leave a Reply