Temasek International, the Singapore state investment fund, has written off its entire investment in the “bankrupt” exchange FTX, making it the institution that probably lost the most.

The collapse of FTX gave meaning to the “contagion” effect as related to the market turmoil spreading throughout the crypto industry. The FTX empire comprised several different yet interlinked companies.

A “Write-Down” on FTX Investment

The news of FTX contagion has sent waves all across the globe. This time more specifically in Singapore. Temasek, a state-owned investment agency, has decided to write down its entire investment in FTX, given FTX’s financial position.

A write-down is treated as an expense, which reduces net income and tax liability.

“In view of FTX’s financial position, we have decided to write down our full investment in FTX, irrespective of the outcome of FTX’s bankruptcy protection filing,” Temasek said in a statement.

The investment firm invested $210 million and $65 million for a minority stake of ~1% and ~1.50% in FTX International and FTX US, respectively, in two funding rounds from Oct. 2021 to Jan. 2022.

This spending spree accounted for 0.09% of its net portfolio value, which, said the company, “will not have a significant impact on our overall performance.”

Given the current status, the firm is writing off the entire $275,000 that it had poured into the crypto exchange. While it may not be a significant loss in relative terms, Colin Wu, a Chinese crypto reporter, asserted, “Temasek is probably the institution that lost the most on FTX.”

Singapore Firm Says FTX Allegations Amount to Fraud

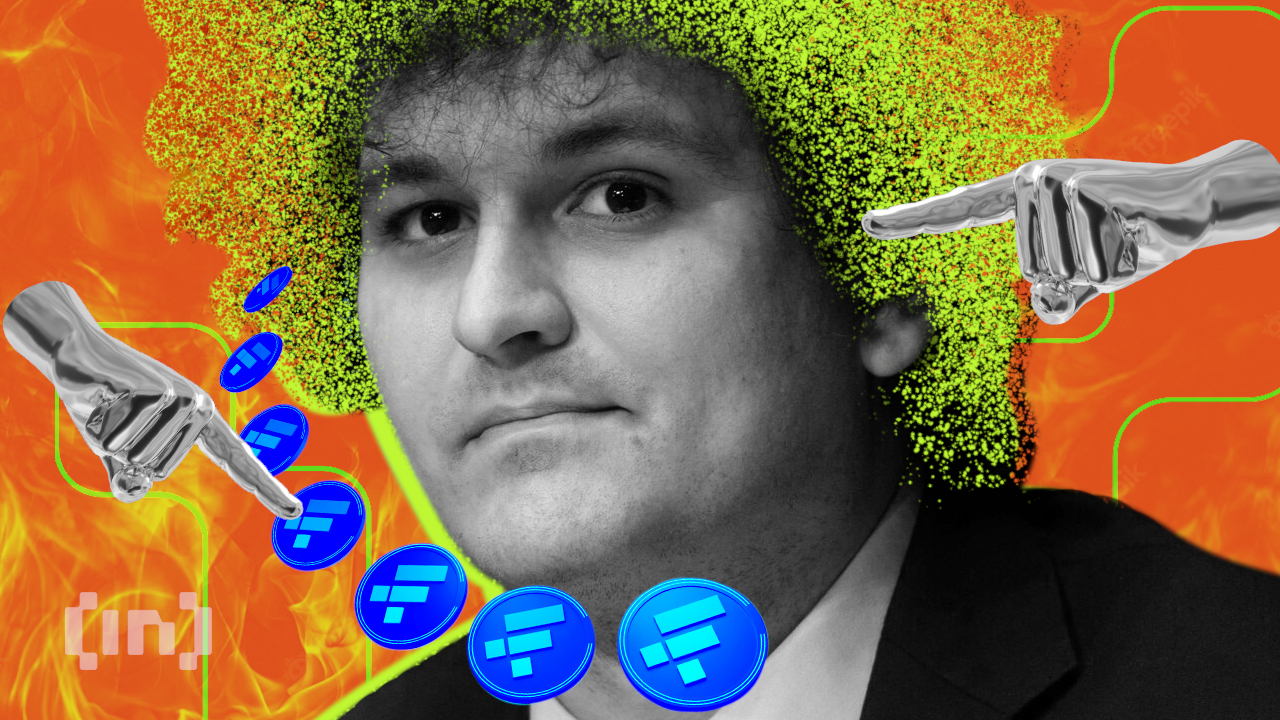

FTX has been the target of different reports alleging that the exchange and its former CEO, Sam Bankman-Fried, mishandled customer assets. The exchange remains under scrutiny from various regulators across the globe. Temasek said that if the allegations were true, it would amount to “serious misconduct or fraud.” The statement further added,

“It is apparent from this investment that perhaps our belief in the actions, judgment, and leadership of Sam Bankman-Fried, formed from our interactions with him and views expressed in our discussions with others, would appear to have been misplaced.”

This announcement comes just days after SoftBank wrote down its $100 million investment in FTX. Meanwhile, Sequoia Capital, too, rode on the same bandwagon.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply