The U.S. nonfarm payrolls report for February indicated that 311,000 jobs were added last month, focusing investor attention on the terminal interest rate the Federal Reserve (Fed) will use to reduce inflation.

The number beat analysts’ estimates of 215,000 and is down from 517,000 new jobs in January.

US Nonfarm Payroll Shows Slowing Job Market

Average hourly earnings rose 0.2%, beating estimates of 0.3%, while unemployment rose 0.2% month-on-month to 3.6%. Retail wages went up 1.1%. Construction jobs were up 24,000, while people who had higher-paying jobs were fired.

The new jobs numbers saw Bitcoin stabilize at around $20,190, up 3% from an intraday low of $19,569. Ethereum was mostly flat after the news broke but fell 1.75% to an intraday low of $1,370 fifteen minutes later.

The jobs report is one of three economic reports that the Fed will use to decide its next rate hike.

The other reports on Consumer Price Index (CPI) and Personal Consumption Expenditure Index (PCI) will be released next week. The CPI captures granular changes in the prices of everyday items like cereal. On the other hand, the PCE is an indicator of changes in consumer spending due to high costs.

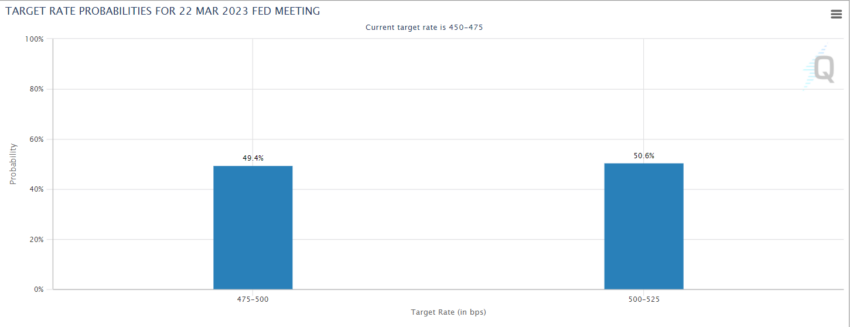

After the news, the Federal Reserve swapped downgraded odds of a 50 basis point rate hike to below 50%.

Economist Samuel Rines told listeners of Bloomberg’s Odd Lots podcast on March 8 that major and middling U.S. corporations were using macro events to introduce disproportionate price increases unrelated to supply and demand.

Considering the Fed’s task to moderate supply and demand through monetary policy, this kind of corporate profiteering means the Fed could be stuck in a perpetual tightening cycle unless it understands what companies are doing.

Analyst Says Focus Is Shifting to Terminal Rate

After the jobs report, which indicated slowing employment, traders struggled to find reliable clues on the size of the next interest rate hike.

Earlier this week, traders assumed that the Fed would increase the Federal Funds rate, which stands at 4.57%, by 50 basis points at the next Federal Open Markets Committee meeting. Chair Jerome Powell strengthened this line of thinking in speeches earlier this week.

However, Ira Jersey from Bloomberg Intelligence said that the focus is shifting from the actual increases to the final or terminal interest rate required to bring inflation down to the Fed’s target of 2%.

The probability of the terminal rate exceeding 5% increased from around 35% before the job numbers to 50.6% at press time, according to CME’s FedWatch tool.

On Thursday, the Biden administration released its $7 trillion “blu-collar” budget. If approved, it would impose a 25% tax on citizens with assets exceeding $100 million.

The new bill would rescind tax breaks that allowed crypto traders to sell assets at losses and reap benefits before repurchasing. MicroStrategy employed this strategy towards the end of 2022.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Leave a Reply