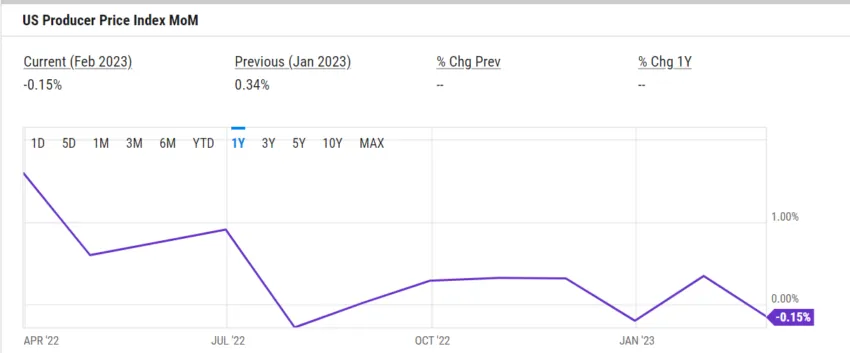

Bitcoin holds its $25,000 resistance level after wholesale inflation fell 0.1% month on month in Feb. 2023, lower than analysts’ estimates of 0.3%.

The U.S. Producer Price Index rose 4.6% yearly, down 1.1% from January 2023 and 0.8% below analysts’ predictions.

Lower Wholesale Inflation Keeps Bitcoin at $25,000

Following the PPI numbers, Bitcoin maintained a resistance level of $25,000 after recording its best four-day stretch ending March 14 since Feb. 2021. In the last four days, Bitcoin peaked at $26,500 but has since fallen to below $24,800.

The U.S. Bureau of Labor Statistics releases the PPI number during the second week of each month.

Unlike the Consumer Price Index, which measures changes in consumers’ prices, the PPI measures what producers pay to create finished goods. PPI is also known as wholesale inflation.

So-called core PPI, excluding food, energy, and trading services, rose 0.2% in Feb. 2023, down 0.3% from Jan. 2023.

Retail spending fell 0.4% in Feb. 2023, with the biggest drops occurring of 4% in department stores, 2.5% in furniture stores, 2.2% in food services, and 1.8% in motor vehicles and parts dealers.

Credit Suisse was down 29% to sub-$1.60 price levels in Swiss trading after investor Saudi National Bank said it wouldn’t provide any more money. The stock has since recovered, rising to $1.72 at press time.

The bank took down several other banking stocks, including JPMorgan, Wells Fargo, and First Republic Bank.

The shares of First Republic fell 19% in premarket trading after Moody’s downgraded the firm for relying on funding from uninsured deposits and holding deposits from a narrow pool of industries.

Yesterday, the U.S. Labor Department announced that the CPI for Feb. 2023 increased 0.4% month-on-month and 6% annually, matching Dow Jones estimates.

Federal Reserve Likely to Stick With 25 Basis Point Hike

Last week, CME’s Fedwatch tool increased the Fed’s probability of raising interest rates by 0.5% at its next Open Markets Committee Meeting.

The increase came after Federal Reserve Chair Jerome Powell said that the Federal Reserve could escalate the size and pace of future rate increases needed to bring inflation back down to 2%. Powell attributed the continued hawkish stance to a strong labor market with only 3.6% unemployment in Jan. 2023.

He added that the Fed would use February’s PPI and Consumer Price Index numbers and the health of the U.S. job market to determine the size of its next rate hike.

“Investors believe that the Fed has taken a 50 basis-point hike off the table for next week, and at worst there will be a 25 basis-point hike, and perhaps no more hikes at all. Bitcoin … was able to harness this sentiment and move to risk-on before all other assets,” noted James Lavish of Bitcoin Opportunity Fund.

The Federal Reserve uses monetary policy to restore imbalances in supply and demand. Lower retail sales indicate that Fed’s policy tightening has reduced demand. It increased interest rates by 4.5% in the past year to combat loose monetary policy and Covid-19 supply chain snarls that fueled demand.

The Personal Consumption Expenditure Index, the Fed’s preferred inflation gauge, will be released on March 31, 2023. The PCE index captures changes in consumer behavior due to increasing prices. A key area of focus with the PCE index is the cost of medical care.

The rate hikes stung Signature Bank and Silicon Valley Bank, which sold securities at steep losses to raise liquidity. The Federal Deposit Insurance Corporation has taken both over.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Leave a Reply