Crypto users in India could potentially cross the 150 million mark this year, according to a report shared with BeInCrypto. This would give India more than half the global crypto users’ market share. What factors could help accelerate this?

Over the past six years, India has experienced a significant rise in crypto investors, despite the government’s historically negative attitude toward the sector.

Various factors, including the rise of fintech, the adoption of mobile technology, and the increasing popularity of digital payments, have driven the growth of cryptocurrencies in India.

India’s Potential to Incorporate Crypto

One of the primary reasons for the growth of cryptocurrencies in India is the rise of fintech. Fintech companies increasingly use blockchain technology to create innovative financial products and services. These companies leverage cryptocurrencies to enable peer-to-peer payments, cross-border transactions, and micropayments. As fintech grows in India, cryptocurrencies will likely play an increasingly important role in the financial ecosystem.

Another reason for the growth of cryptocurrencies in India is the adoption of mobile technology. India is home to the world’s second-largest smartphone market, with over 1 billion smartphone users. This has created a large user base comfortable with digital payments and has the technology necessary to invest in cryptocurrencies. Furthermore, the rise of mobile wallets in India has made it easier for people to transact in cryptocurrencies.

The increasing popularity of digital payments is also driving the growth of cryptocurrencies in India. The government’s push toward a cashless economy has led to a surge in digital payments. Many people use mobile wallets and digital payment platforms to pay for goods and services.

Cryptocurrencies offer a secure and convenient digital transaction, contributing to their growing popularity.

Regulatory Hurdles Lie on the Way

Despite the growth of cryptocurrencies in India, the government has been historically skeptical of the sector. In 2018, the Reserve Bank of India (RBI) issued a circular prohibiting banks from dealing with cryptocurrencies. This had a direct impact as it led to a temporary drop in the value of cryptocurrencies in India. However, the Supreme Court of India overturned the ban in March 2020, which led to a renewed interest in cryptocurrencies. Nonetheless, the tussle continues to create headlines in 2023.

Of late, Indian authorities barred crypto advertising and sponsorships in the local women’s cricket league. This followed a previous ban for the men’s cricket Premier League, introduced back in 2022. While the government has yet to embrace cryptocurrencies fully, there are signs that it is becoming more open to the sector. In 2021, the Ministry of Corporate Affairs proposed amendments to the Companies Act, requiring companies to disclose any cryptocurrency investments. This suggests that the government is more proactively regulating cryptocurrencies and recognizing their potential value.

A report shared with BeInCrypto by the team at BitcoinCasinos.com highlights some interesting statistics to support the narrative. The report found that, within the last 6 years, India has witnessed a surge in crypto users despite regulatory hurdles.

India Could See More Than 150M Crypto Users This Year

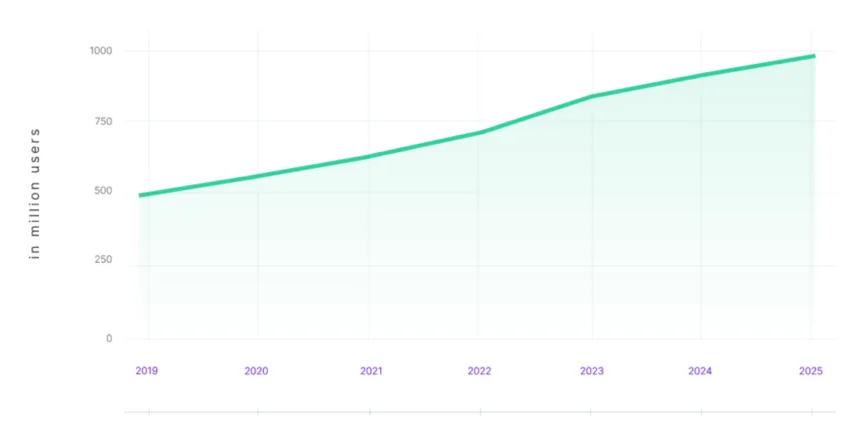

The cryptocurrency market has gained significant traction in recent years and is increasingly being used as a medium of exchange and store of value. It is expected to account for around $43B in transactions globally. This is a 24% jump from $34.3 billion last year.

The exact value of cryptocurrency transactions worldwide can vary depending on market conditions, global adoption rates, and regulatory changes.

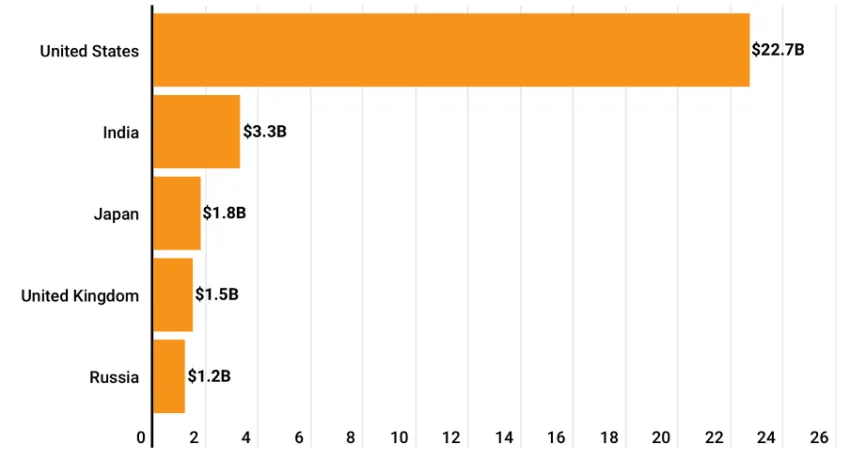

Considering this, over half of that value will come from the United States, the world’s largest crypto market. Still, given the setbacks, crypto ownership in the U.S. is still far behind India.

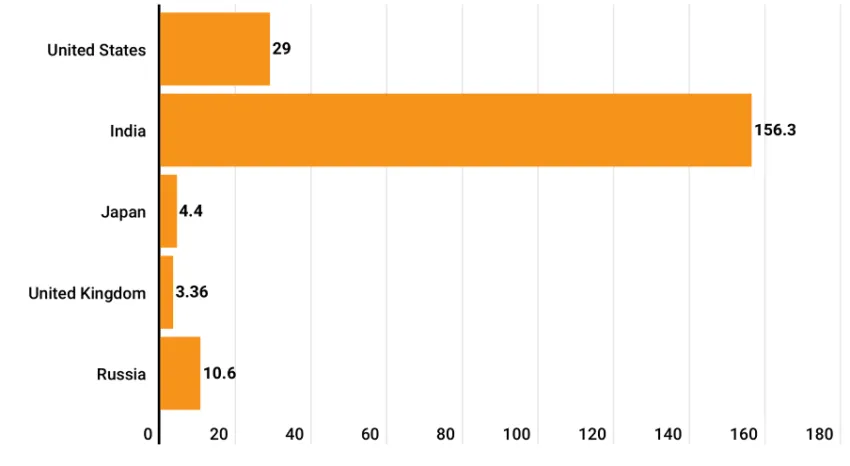

The research claims, ‘India is expected to hit over 156 million crypto users in 2023, or five times more than the United States.’

The COVID-19 pandemic was a big turning point for the region. The country’s cryptocurrency market gained traction during the pandemic, mostly due to poor financial infrastructure.

The number of crypto users skyrocketed by 760% between 2017 and 2022 to 134 million.

India Accounts for the Majority of Crypto Users

The team told BeInCrypto,

“With 156 million people using digital coins in 2023, India will have three times more crypto users than the United States, Japan, United Kingdom, and Russia combined.”

Overall, global crypto users are anticipated to surge to 293 million, a hike from 257M users in 2022. Undoubtedly, India will play a key role. The U.S. has less than a 10% share in the global crypto user count, and this number could potentially fall further amid increased scrutiny from regulatory watchdogs.

In conclusion, India has seen a significant rise in crypto investors over the past six years, driven by the rise of fintech, the adoption of mobile technology, and the increasing popularity of digital payments. While the government has been historically hostile toward cryptocurrencies, there are signs that it is becoming more open to the sector. As the Indian economy evolves, cryptocurrencies will likely play an increasingly important role in the financial ecosystem.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Leave a Reply