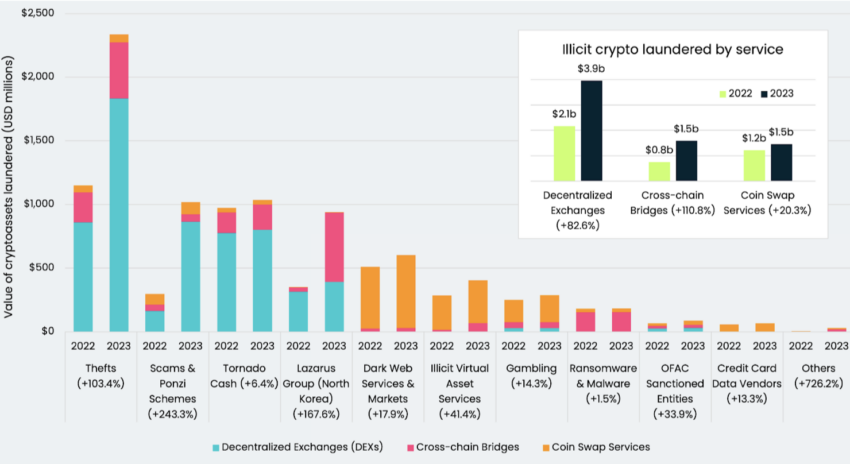

Crypto risk management firm Elliptic revealed the total amount of illicit funds laundered through decentralized exchanges (DEXs), cross-chain bridges and coin swap services has soared to $7 billion.

“Our latest figures suggest that it is fast becoming the preferred money laundering method for a range of cybercrimes,” the report stated.

Cross-Crime Crypto Laundering Exceeds Predicted Growth

A recent report shows that the latest data has exceeded Elliptic’s earlier predictions:

“We estimated then that this $4.1 figure would rise to $6.5 billion by the end of 2023 and $10.5 billion by 2025. Our latest calculation of $7 billion, however, shows that cross-chain crime is rising at a faster rate than predicted.”

Crypto money laundering predominantly involves the act of swapping cryptos between different tokens and blockchains, a phenomenon often referred to as cross-chain criminal activity.

People use this method to conceal funds acquired through various means, including scams and crypto thefts.

Additionally, it acknowledges that its earlier estimate of $10.5 billion may no longer hold true, as the rates are currently exceeding the initial predictions.

Elliptic highlights two factors contributing to the rise in cross-chain criminal activities.

Firstly, criminals are increasingly gravitating towards cryptos other than Bitcoin. These cryptos offer attractive features like anonymity and stability, often achieved through their connection to government-backed stablecoins.

At the time of publication, Bitcoin’s price is $27,821.

However, the report indicates that criminals are adopting cross-chain strategies to outwit authorities. This is to keep their ill-gotten gains hidden and to stay ahead of law enforcement:

“Furthermore, as we revealed elsewhere recently, enforcement actions such as seizures and sanctions are increasingly targeting traditional frontiers of crypto criminality. This is causing a so-called “crime displacement” effect, in which fraudsters and criminals are turning to cross-chain crime as an alternative.”

BeInCrypto previously reported that the rise of cross-chain crime is a new but swiftly growing trend. During the first half of 2022, there was a notable 58% surge in thefts facilitated by cross-chain bridges when compared to the same period in 2021.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Leave a Reply