The Shiba Inu (SHIB) price has fallen since a confluence of resistance levels rejected it on November 12.

The price now trades at a critical horizontal support area. Will it bounce or break down?

Shiba Inu Does Not Break Out

The technical analysis from the weekly timeframe shows that the SHIB price has fallen under a descending resistance trend line since August 2022. So far, the trend line has been in place for 470 days.

Shiba Inu was rejected by the trend line last week and the one before (red icons), initiating the ongoing downward movement. These were the third and fourth rejections from this trend line.

While the SHIB price may be trading inside a descending wedge, its support line (dashed) has yet to be validated sufficient times.

Read more: Shiba Inu (SHIB) Price Predictions

When evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

The weekly RSI is right at 50, indicating an undetermined trend.

The Shib Magazine 3rd edition went live today, and 5,000 unique Non-Fungible Tokens (NFTs) of the magazine cover are up for grabs. The Shibarium Network entered the top 5 most active networks in the NOWNodes platform. As a result, the platform increased the capacities for Shibarium RPC node utilization.

What Do the Analysts Say?

Cryptocurrency traders and analysts on X have a positive view of the future SHIB price.

Shib Knight tweeted that

$SHIB has a strong support. Price action is positive, building slowly

He suggests that the trend is bullish as long as the price continues following the ascending support trend line.

MyAlgo, who uses a trading algorithm to enter and exit trades, stated that a bullish signal had been given, expected to take the SHIB price higher.

SHIB Price Prediction – Breakout or Breakdown?

The altcoin’s outlook remains uncertain in the daily time frame.

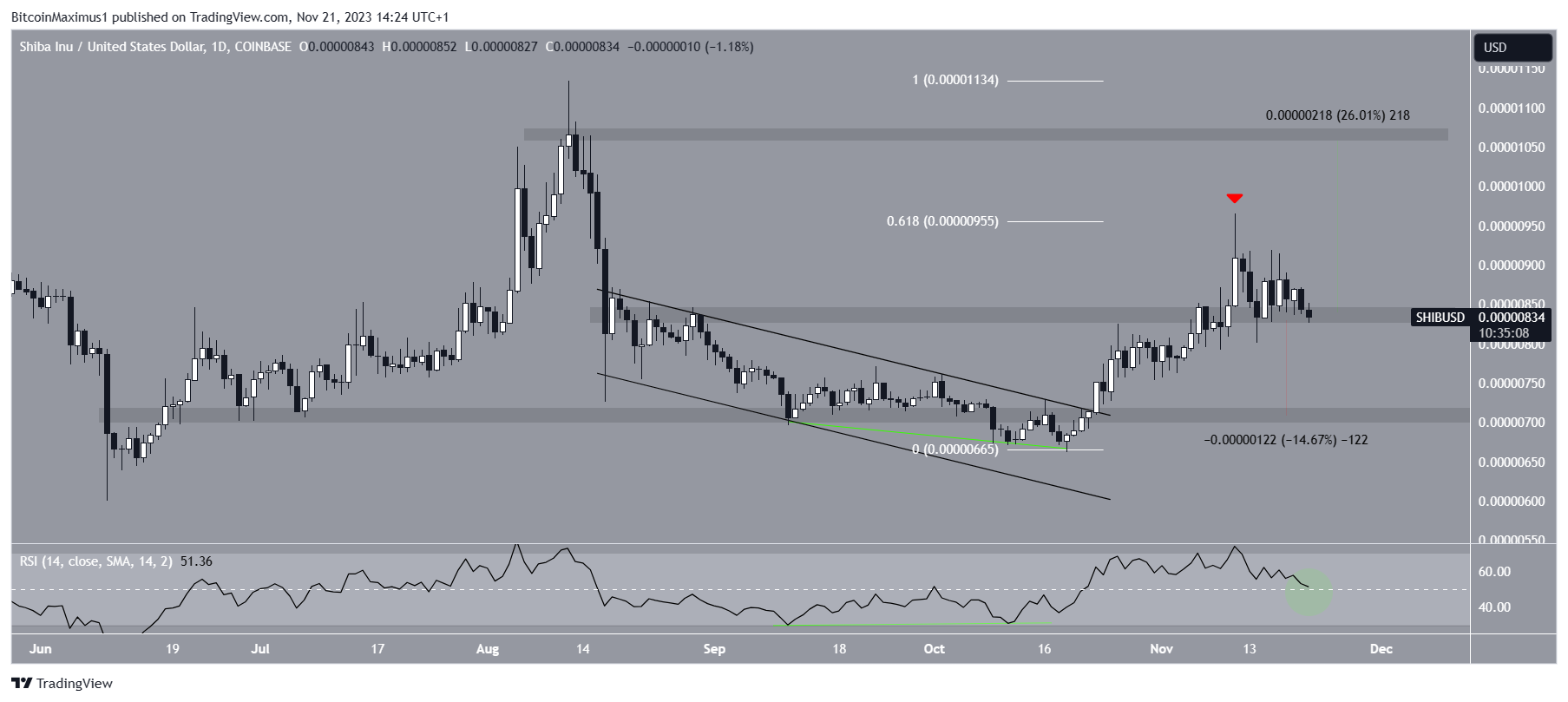

Despite a bullish breakout from a descending parallel channel, with SHIB reclaiming the $0.00000840 level and reaching $0.0000098, it faced rejection at the 0.618 Fib retracement resistance level. This resulted in a lengthy upper wick, considered a sign of selling pressure.

The preceding SHIB price increase was accompanied by a bullish divergence (green trend line) in the six-hour RSI, indicating a potential upward movement. A bullish divergence occurs when a momentum increase accompanies a price decrease.

However, it’s important to note that the RSI has declined over the past three days and is now at the critical level of 50 (green circle).

Similarly, the SHIB price has fallen since the rejection from the 0.618 Fib level. It currently trades inside the $0.0000084 horizontal support area.

In summary, the future price prediction for SHIB hinges on whether it breaks below the $0.0000084 horizontal support or rebounds above it.

A breakdown could lead to a 15% decline to the nearest support at $0.0000070, while a bounce might result in a 25% increase, pushing Shiba Inu towards the next resistance at $0.0000105.

For BeInCrypto‘s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Leave a Reply