San Francisco fintech firm Ripple is no longer pursuing an initial public offering (IPO) in the United States. Furthermore, the firm’s chief executive officer said that Ripple was exploring options outside the US due to “hostile” conditions.

On January 16, Ripple CEO Brad Garlinghouse spoke to reporters at the World Economic Forum in Davos, stating the company has put any plans for an IPO on hold for now.

Ripple Puts IPO on the Backburner

The crypto executive said the company explored going public outside the US due to a “hostile” SEC regulator.

The firm is currently embroiled in a three-year-long legal battle with the US Securities and Exchange Commission, which sued it in 2020 for selling unregistered securities.

Back in 2022, Garlinghouse said the firm was exploring a public listing after the lawsuit. Fast forward to 2024—the courtroom tussles are still ongoing, and those plans have been stymied.

“In the United States, trying to go public with a very hostile regulator that’s approved your S-1, that doesn’t sound like a lot of fun to me.”

He mentioned the other major crypto firm that has gone public, Coinbase, which had its application approved. “And now the SEC is suing them for doing things that were outlined in their S-1,” he said.

An S-1 SEC document is the initial registration form for new securities or an IPO required by the regulator for public companies that are based in the US. Rumors of a Ripple IPO emerged in October after the firm published a job listing for a Shareholders Communications Senior Manager.

Read more: How To Buy XRP and Everything You Need To Know

The Ripple boss added that the firm is keeping the IPO “option open” and will evaluate it as time continues or if regulators change:

“And we’ll evaluate again, as we have new regulators sitting at the United States SEC.”

Garlinghouse has been highly critical of SEC chair Gary Gensler, who considers himself a crypto “cop on the beat.”

Speaking to CNBC on January 16, he said Gensler was a “political liability:”

“I do think the chair of the SEC, Gary Gensler, is a political liability in the United States. And I think he’s not acting in the interests of the citizenry, he’s not acting in the interests of the long-term growth of the economy, and I don’t understand it.”

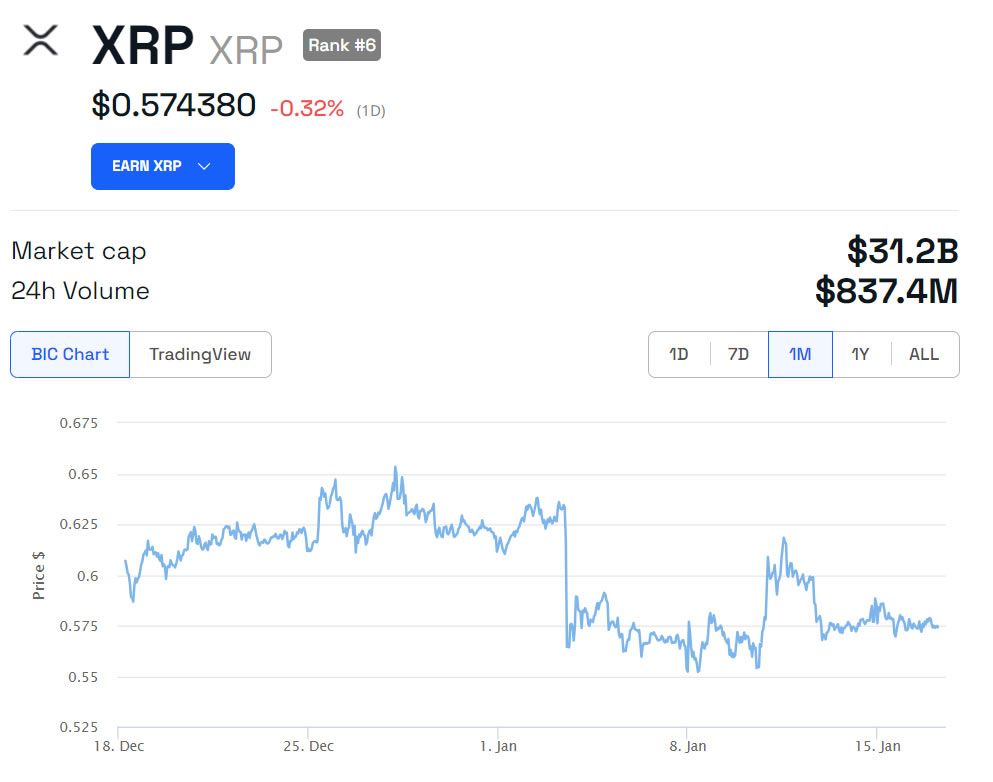

XRP Price Moves Sideways

The company’s native token, XRP, has been lackluster in terms of price action during the recent crypto market rally.

XRP is currently trading flat on the day and the past week at $0.574 at the time of press.

Moreover, the cross-border transfer token has dropped 8% since the beginning of 2024. XRP is still down a painful 83% from its 2018 all-time high of $3.40.

Even rumors of a spot XRP ETF haven’t been enough to sway crypto traders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply