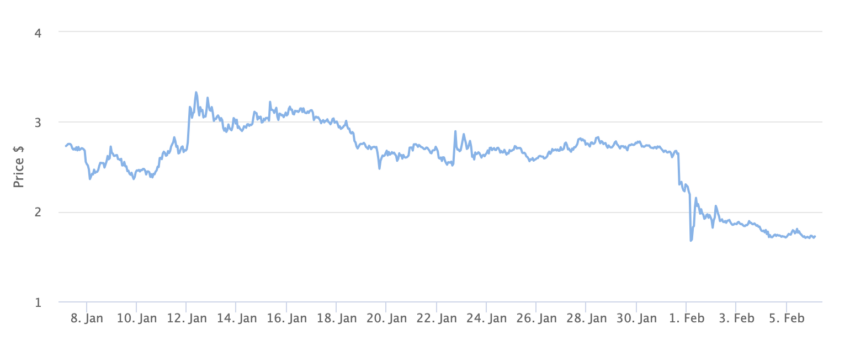

The FTT token, the native token of the now-defunct crypto exchange FTX, has recently faced a significant decline. Speculation arises from FTX’s decision not to resume operations, contrasting earlier expectations.

This comes after positive price movement and optimistic predictions for FTX’s revival just months ago.

FTX Not Relaunching Sparks FTT Collapse: Research Firm

Kaiko research reveals a substantial decline in the FTT token after the announcement that the crypto exchange FTX would not be relaunching following its November 2022 collapse.

“FTX exchange token FTT lost more than 30% of its value last week after reports that the exchange will not be reviving its operations. FTT which has no real use case after the collapse of FTX – has seen its price more than triple since November 2023 on FTX revival hopes.”

At the time of publication, FTT price stands at $1.73.

It was only in April 2023, that FTT pumped over 100% at the news that FTX may return.

The legal team for FTX never confirmed the rumors, but did hint that it may be possible and something that would be explored in 2024. However, did state that it would require a significant amount of capital.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

FTX Bolsters Repayment Plan, Despite FTT Token Price Decline

However, despite the price decline, debtors of FTX are making significant process in consolidating a payment plan to repay its creditors, following the collapse.

This focus is replacing the previous efforts to restart the exchange.

Read more: Who Is John J. Ray III, FTX’s New CEO?

BeInCrypto recently reported that this decision comes after months of negotiations with potential bidders and investors. These did not materialize into sufficient funding for rebuilding the exchange.

Meanwhile, earlier reports highlighted FTX’s notable progress in asset recovery, securing over $7 billion to repay customers.

Disbursing these funds relies on crypto’s values from November 2022 during a market slump. This choice has sparked customer complaints due to perceived undervaluation, given Bitcoin’s substantial price increase since then.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Reply