Key Takeaways

- Bitcoin touched $44,000 Monday, helping the rest of the crypto market soar.

- Many lower cap assets outpaced Bitcoin and Ethereum.

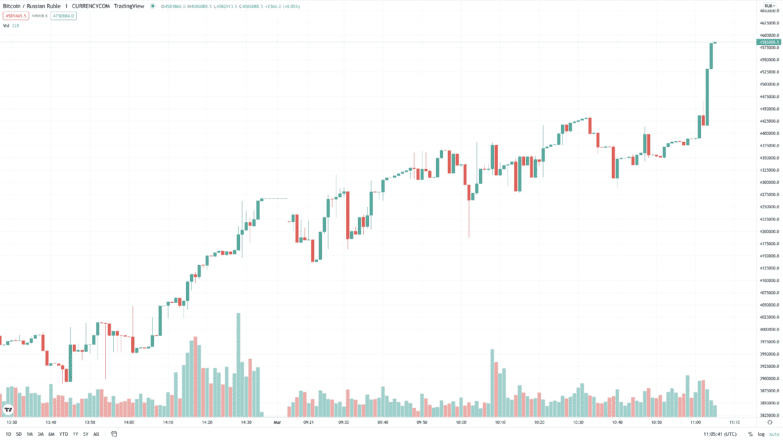

- The rally came as the Russian ruble plummeted following the West’s move to isolate Russia from the global economy over its Ukraine attack.

Share this article

Most major crypto assets jumped after Bitcoin reclaimed $40,000 Monday. The Russian ruble, meanwhile, opened the week deep in the red.

Crypto Market Gains Momentum as Bitcoin Rallies

The crypto market looks bullish again.

A late Monday buying frenzy helped most major assets surge with Bitcoin leading the charge. The top crypto rallied after reclaiming the crucial $40,000 psychological barrier, briefly crossing $44,000. Bitcoin has since cooled to around $43,188.

As is often the case during a Bitcoin rally, many other lower cap assets gained bullish momentum off the back of its rise. The number two crypto, Ethereum, climbed over 10% around $2,600 but met resistance at the $3,000 level. It’s currently trading at $2,884 and accounts for around 17.5% of the market.

Although Bitcoin and Ethereum are widely seen as the market leaders, their gains were overshadowed by many other major crypto assets. Near, Terra, and Fantom, three Layer 1 networks that are sometimes described as competitors to Ethereum, respectively ran 22.3%, 20.9%, and 15.1% as the market picked up. The Cosmos ecosystem also showed strength; Cosmos’ native ATOM token gained 12.9%, the interoperable smart contract network JUNO jumped 16.4%, and Osmosis, a decentralized exchange for trading IBC-compatible tokens, saw its OSMO token rise 11.1%.

After the market rally, the global cryptocurrency market capitalization is just below $2 trillion, which is still around 33% short of its November all-time high. Crypto and global markets have looked shaky in recent weeks under the weight of ongoing macroeconomic concerns. The market started to bleed after hitting highs in November and plummeted as traders went risk-off on fears of the COVID-19 Omicron variant. The Federal Reserve then announced it would be hiking interest rates in 2022 (rate hikes are often bearish for risk-on assets as the cost of borrowing money increases).

Global markets then took a hit as Russia invaded Ukraine Thursday. Russian stocks fared particularly badly as the MOEX Russia Index closed 33% in the red. Western countries and much of the rest of the world—including typically neutral nations like Switzerland—have since united to impose strict economic sanctions on Russia. Vladimir Putin’s nation has now been cut from the SWIFT payments system, and 50% of the Bank of Russia’s assets have been frozen. Since the West announced the unprecedented measures over the weekend, Russia has taken emergency precautions in efforts to save its economy. The Moscow Exchange was closed for trading Monday, and the key rate has been hiked to 20%. As the ruble has plummeted around 30%, Russian traders have been selling Bitcoin at a premium on the peer-to-peer marketplace Localbitcoins.com. That may also explain why the asset rallied so hard last night, giving credence to Bitcoin’s “safe haven” narrative.

Disclosure: At the time of writing, the author of this feature owned ETH, ATOM, and several other cryptocurrencies.

Share this article

Treasury Revives Russian Sanctions Referencing Crypto

The U.S. Treasury has published a document indicating that it will expand upon sanctions against Russia put in place last year. One section makes specific reference to digital currency. Executive…

Leave a Reply